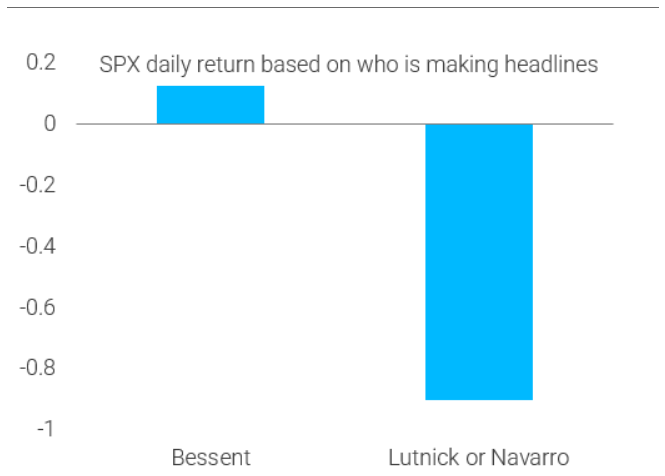

| China and the US have agreed a three-month truce in their trade conflict, and the effect on financial markets has been galvanizing. You can read up on the cut in US tariffs to 30% from 145% here and here. For the longer term, neither side appears to have made any concessions. This is an agreement to pause and talk. But investors, who were blindsided by last month's swift descent into all-out trade war, rejoiced. The impact on stocks, which gained more than 3%, capped an extraordinary 22-day surge. The gain since April 9, when President Donald Trump announced a similar 90-day pause for countries other than China, now ranks with the biggest such rallies since 1990: Traders assumed that tariffs at an extreme 145%, which were in effect on China for the last five weeks, would almost guarantee a US recession. For bettors on the Polymarket prediction market, a downturn this year is now less likely now than it was on April 1: The market leadership of the biggest tech stocks, punished in the tariff selloff, has returned. Bloomberg's index of the Magnificent Seven companies is back above its 200-day moving average both in absolute terms and relative to other US stocks: Does this mean that the whole incident passes the Bobby Ewing test? For the uninitiated, this is named for an entire season of the Dallas soap opera which took place after Bobby had died, only for it to emerge at the beginning of the next season that he was still alive; his death and the entire season had been a dream in his wife's mind and could be forgotten. Despite the market's remarkable round trip, however, it's doubtful that this episode can be dismissed as though it hadn't happened. Stocks have rebounded, and they've even outpaced bonds since April 2, while the VIX measure of market volatility is lower than it was then. But gold has held on to most of its advance, oil is down, and non-US stocks are still outpacing the S&P: The easing fear of recession makes rate cuts from the Federal Reserve less likely than they were. Fed funds futures were braced for steep cuts on April 8, the day before the 90-day reprieve on tariffs for the world outside China. That's over. No big new tariffs means no big new reason for the Fed to cut: Another issue is that Treasury 10-year yields are rising, as they have since the market hit bottom during Covid. The 10-year yield trended down for more than three decades before the pandemic, but over the last five years it has established a new trend: The concerns that animated the world before April 2 have not gone away, and the pressure from the bond market to limit fiscal largesse is intensifying (at least in part because erratic policymaking makes investors more reluctant to buy). Two crucial elements of the Trump Trade — that yields would come down, and that US stocks would continue their long outperformance of the rest of the world — are still lacking. For now, the judgment remains intact that at the margin, there's reason to transfer assets out of the US, even if the tariff climbdown has quashed talk of the fall of the dollar or the collapse of the American empire. Battle of the Narratives To explain, it's best to turn to an early candidate for the title of cruelest financial chart of the year, produced by Dario Perkins of TS Lombard. It compares the cumulative S&P 500 performance on days when either Peter Navarro (trade adviser) or Howard Lutnick (commerce secretary) are leading the headlines, compared with days when Treasury Secretary Scott Bessent gets more coverage. Sorry, Peter and Howard, the market doesn't seem to like you:  Source: Dario Perkins, TSLombard Other measures confirm this picture. A Bloomberg News Trends search, counting all stories from all sources that appear on the terminal, shows Bessent with generally more coverage than Navarro. The selloff was at its worst after Liberation Day, when Navarro did the rounds of the television studios: In US Google searches, rather than stories aimed at the terminal's financial audience, Navarro has hogged attention this year — but Bessent has recently overhauled him: It looks like Bessent has won an internal conflict, so he's the one briefing the press. Bessenomics is popular with the market, and Navarronomics is not. Bessent is synonymous in market minds with a more transactional take on traditional Republican economics (i.e. that Trump has just been negotiating), while Navarro represents a total reordering of global trade. Optimism that Trump 2.0 would follow Bessent's agenda (fiscal discipline, lower oil prices, lower bond yields and deregulation) and ignore Navarro-inspired tariffs (or a crackdown on migration, which Wall Street fears would force up inflation) drove the post-election rally. With Republicans now getting to grips with the budget and taxes, the agenda that Wall Street expected at the turn of the year is finally falling into place. That at least is the narrative for the moment. Traders can get back to worrying about taxes and spending. But Liberation Day will still make the data hard to read for a while… |

No comments