| Bloomberg Evening Briefing Americas |

| |

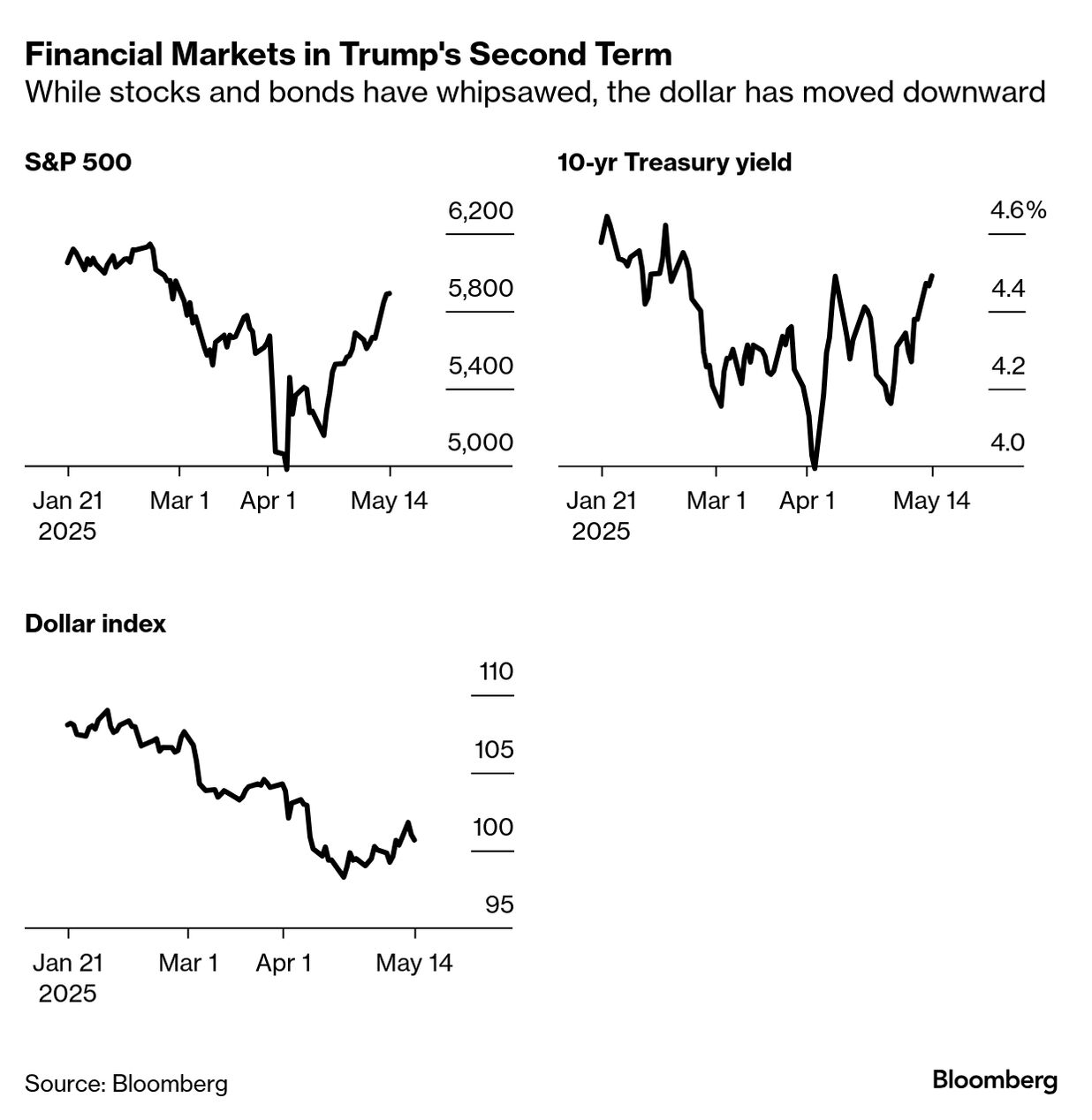

| The big rebound from April's "reciprocal" tariff meltdown may be running out of gas. After a 22% jump from last month's intraday lows, the S&P 500 edged up just 0.1% on Wednesday. Most sectors fell, but big tech climbed. The dollar erased losses after a person familiar with the matter told Bloomberg News the US isn't actually working to include currency policy pledges in any trade accords. The dollar has fallen some 8% overall against world currencies since Donald Trump took office. The Republican has a long history of complaining that other countries—especially in Asia—deliberately weaken their currencies to gain a commercial edge over America. The US president has sought to impose tariffs on most of the world (though there's an open question as to whether he has the power to do so) and is now dangling the possibility those levies will be dialed back as he engages in trade talks with multiple countries.  Trump has tapped advisers such as Stephen Miran, chair of the White House Council of Economic Advisers, whose previous work mapped out a path to alleviating what he's called the "burdens" of owning the world's reserve currency. That in itself may be why market participants are concluding that the logic of Trump's stated goals—a smaller trade deficit and a US manufacturing revival—point toward a weaker greenback regardless of how the currency policy is officially characterized. "Talk of currency coordination may be premature, but FX traders are clearly sniffing around the edges," said Haris Khurshid, chief investment officer at Chicago-based Karobaar Capital. "Whether or not the US formally includes currency in trade talks, markets are already trading as if a weaker dollar is implicit." —David E. Rovella | |

What You Need to Know Today | |

| |

|

| Thrive Capital, the venture firm founded by Josh Kushner, told investors last week that one of its funds made $522 million on an unusual bet—an investment in publicly traded car marketplace Carvana. The windfall, outlined in a letter to investors reviewed by Bloomberg, underscores Thrive's expansion beyond traditional startup investing, including public market trading and, recently, a plan to start and buy businesses it thinks can benefit from artificial intelligence. That's in addition to Thrive's large bets on private businesses like OpenAI and Stripe. The Carvana trade more than quadrupled what Thrive invested, the letter said, a win for the firm's $2.5 billion growth fund. It also offered a rare payout for investors at a time when initial public offerings and big acquisitions have been scarce. The firm said it would distribute $454 million to its backers, called limited partners, after selling a chunk of its stake in the used car retailer. | |

|

| |

|

| Canada has effectively suspended almost all of its retaliatory tariffs on US products, tamping down inflation risks and improving its growth outlook, according to Oxford Economics. In March, the government imposed new import taxes of 25% on about C$60 billion ($43 billion) of US-made goods in response to the first round of tariffs from the Trump administration. Canada also retaliated against US auto tariffs in early April by putting its own levies on US vehicles. But Prime Minister Mark Carney's government then announced a six-month tariff exemption for products used in Canadian manufacturing, processing and food and beverage packaging, and for items related to health care, public safety and national security. Automakers got a break, too: companies that manufacture in Canada, such as General Motors, are allowed to import some vehicles into Canada tariff-free. All told, those exemptions, according to Oxford calculations, mean Canada's tariff-rate increase on the US is "nearly zero." | |

|

| |

|

| In 2017, then-Senate Majority Leader Mitch McConnell used the arrival of Trump in Washington to push through a wish list of Republican tax cuts. The big bill also included the reduction of a tax break: It capped the amount of state and local taxes one could deduct—a direct shot at states with higher tax rates, which coincidentally tend to be Democratic leaning. Fast forward eight years, and Congress is again controlled by the GOP. Only this time, with razor-thin majorities in both houses and inflation at risk of re-ignition, the party is looking to undo some of that blue state punishment to protect a few of its members from a midterm shellacking. But beyond that novel turnabout, the bulk of the newly proposed tax bill by the current GOP-controlled Congress bears a striking resemblance to the bill signed into law by Trump in 2017. Wealthy Americans and business investors again are among the big winners, and much of their winnings will come from the poor, as low-income Americans see their Medicaid health coverage and food stamps cut. There also are a few potshots taken at immigrants and universities. Though its early days and things can change, here are the winners and losers. | |

| |

|

| This is a bad week for Israel, and by all appearances that's just fine with the US president, Andreas Kluth writes in Bloomberg Opinion. Trump has choreographed several plot lines to send a single message: He will do whatever he thinks will redound to his own glory, even if that means freezing out Benjamin Netanyahu. Kluth writes that it's hardly a coincidence that Hamas released its last living hostage bearing a US passport as Trump set off to the Middle East on a trip that conspicuously omits Israel.  A bomb crater after an Israeli airstrike at the Gaza European Hospital in eastern Khan Younis on Wednesday. Photographer: Ahmad Salem/Bloomberg Meanwhile, the embattled Israeli prime minister, accused of war crimes by the International Criminal Court while facing a sprawling corruption prosecution at home, is coming under attack by French President Emmanuel Macron, who accused him of "shameful" behavior in blocking aid to the Gaza Strip, and called on the European Union to toughen its stance against Israel. More than 2 million people live in the Palestinian territory, devastated by 19 months of war that has killed tens of thousands of non-combatants. Most in Gaza have been displaced and famine has become a "critical risk," international aid groups said. Netanyahu has been blocking assistance since March, saying he has done so to force Hamas to release its remaining hostages. The aid blockade began around the time a ceasefire agreement with the militant group collapsed. Israel continued strikes on Gaza overnight, with the Associated Press reporting more than 70 people killed, according to local officials. | |

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| | This newsletter is just a small sample of our global coverage. For a limited time, Evening Briefing readers like you are entitled to half off a full year's subscription. Unlock unlimited access to more than 70 newsletters and the hundreds of stories we publish every day. | | | | | | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments