| If you lived in California and had to pay more than $8 for a gallon of gas — a figure that might be reached in 2026 — would you … A) Cry

B) Walk instead

C) Call your representative

D) Move out of the state

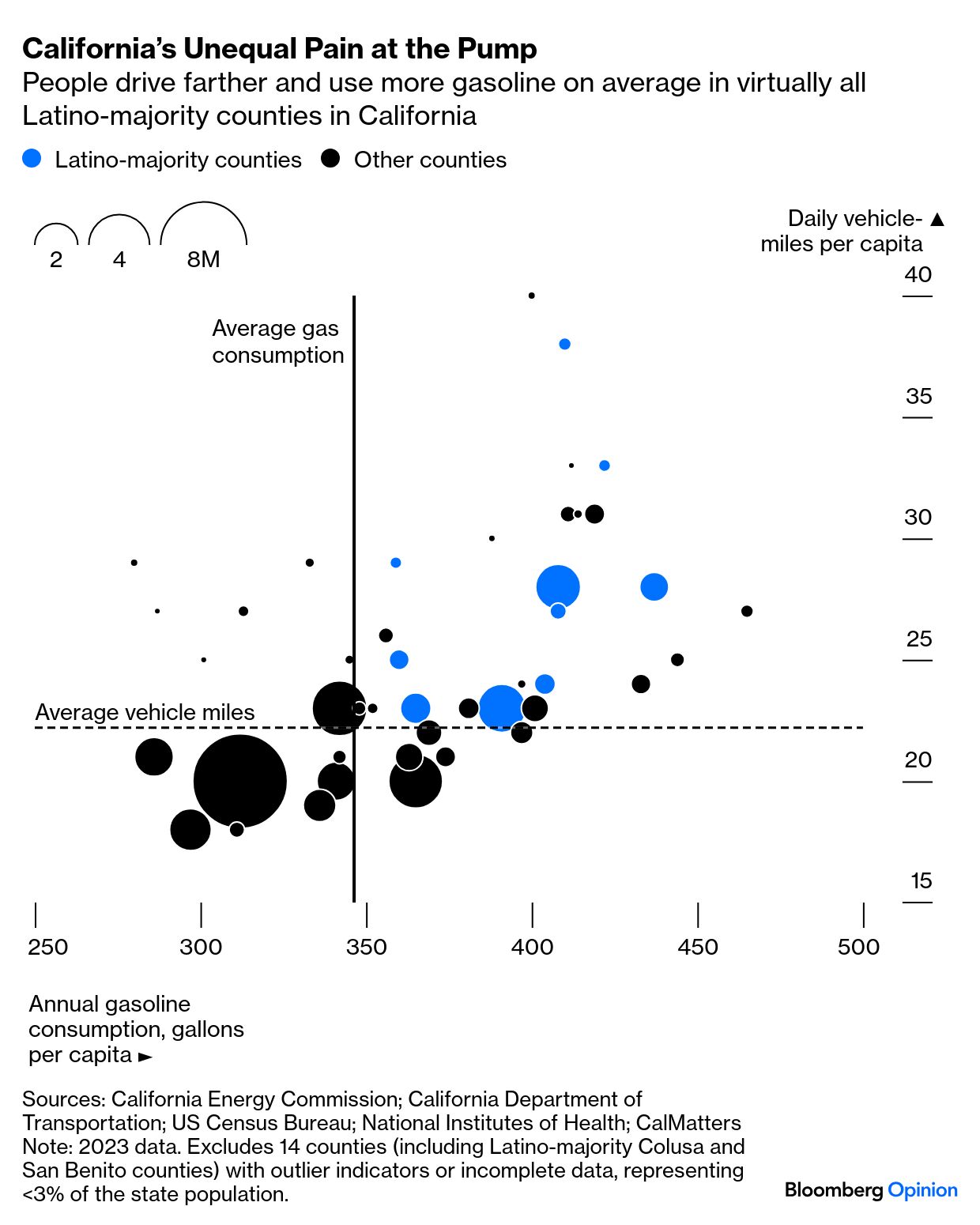

E) All of the above All of the above, duh!! No way am I filling a 14-gallon tank with a week's worth of Erewhon smoothie money. Absurd. And California Governor-slash-podcast bro Gavin Newsom knows it. Despite calling the fossil fuel industry the "polluted heart of this climate crisis" a mere year ago, he's ordering officials to work with oil refiners to "ensure that Californians continue to have access to a safe, affordable and reliable supply of transportation fuels." At first, it looks like a classic political flip-flop in line with Newsom going after homeless camps and yanking health care from undocumented immigrants. Which, yes, Erika D. Smith and Liam Denning say it is — after all, the guy's eyeing a presidential run in 2028. But, as they write, "it's also evidence of rising tension between the state's net-zero objectives and the economic woes of working-class Californians." For those unfamiliar with the Golden State's squeeze on fuel prices, let me catch you up: Two refineries — one in the Bay Area and the other near Long Beach — are on the verge of closing. "The state is losing fuel production faster than it is losing its appetite for gasoline," Erika and Liam explain. Plenty of privileged Californians will look at that chart and wonder why gasoline prices even matter when the Trump administration is taking a chainsaw to the Constitution. But Latino communities — "the gardeners, nannies and construction workers who drive 100 miles roundtrip each weekday" — are scraping by, hence why they supported the candidate who promised to lower prices in 2024: "Trump's vote share increased in all 12 of California's Latino-majority counties. In all but one of those, people on average drive more each day and use more gasoline than for California as a whole, state data show," Liam and Erika say.  "A thorny issue with the energy transition is that states such as California need fossil fuel infrastructure to run even as they take away the economic case for investing in it," they write. It's not as if Prius-driving, paper straw-drinking, tote bag-carrying Californians are going to become climate change deniers overnight. Wildfires, droughts and floods have already shown up on their doorsteps; they know climate change threatens their future. But that doesn't change the fact that it's a painful process that comes with financial hardships. "It might take $192 trillion in global investment in clean energy and efficiency by 2050 to zero out the planet's emissions and limit global warming to barely manageable levels," writes Mark Gongloff. Better to do it now than wait: As Mark says, it's important not to think of clean energy spending as a one-and-done thing: "This isn't buying a $2,000 cardigan at Saks," he writes. "It's buying a heat pump that trims your power bill by hundreds of dollars a year while also cutting the greenhouse-gas emissions heating up the planet and endangering your health, safety and personal finances." Gas pump pain is temporary! Heat pumps are forever. You really can't make this stuff up: HBO went from HBO → HBO Max → Max back to HBO Max in, what, five years? They're trolling us!! But maybe that's the whole point: What's funny is that this feels like something President Donald Trump would do if he was a streaming executive! "Free outraged publicity" is his bread and butter. Think about the language we use to discuss the trade war: "Tariff whiplash." "On-again, off-again." "Escalate to deescalate." All that uncertainty is part of Trump's quest to stay relevant. He does that by being unpredictable. HBO is just trying to do the same thing. But tariffs aren't a branding exercise. They carry real-world consequences for the economy. The fact that nobody knows what'll happen after the 90-day trade reprieve — which officially starts today, May 14 — between China and the US is not good. Bill Dudley says the pause "will lead businesses to delay purchase, investment and hiring decisions." The "corrosive uncertainty" — his words, not mine — wrought upon by these tariffs gives the Fed little wiggle room, he argues: "When it doesn't know which way the risks skew, it must wait for more information." You know what's not waiting for more information, though? The stock market: "The S&P 500, as of now, is showing a gain for 2025. It needs another 4.3% rise to set a record high. The basics of a 15% fall from the start of the year, then recouped in full, haven't been achieved this swiftly since 1982," writes John Authers. For the retail investors who didn't panic and bought the dip, Marc Rubinstein says the market delivered "a gain of about 17% from the lows." Bloomberg's editorial board members are skeptical as to whether the happy-go-lucky vibes can be sustained, though: "If the promised talks should stall and tariffs are pushed back up, the mood is bound to reverse," they write (free read). It's certainly reversed in Europe, thanks to Trump saying the EU is "nastier than China" (there's that free outraged publicity again!). Paris-based columnist Lionel Laurent, who recently popped by our New York Bureau, says his trip made him "acutely aware of how the European continent is an object receding in the geoeconomic rear-view mirror." Hmmm. Maybe it's time for a rebrand. Bonus Tariff Reading: Trump is wise to tone down his trade war before the economy begins to sour. — Jonathan Levin |

No comments