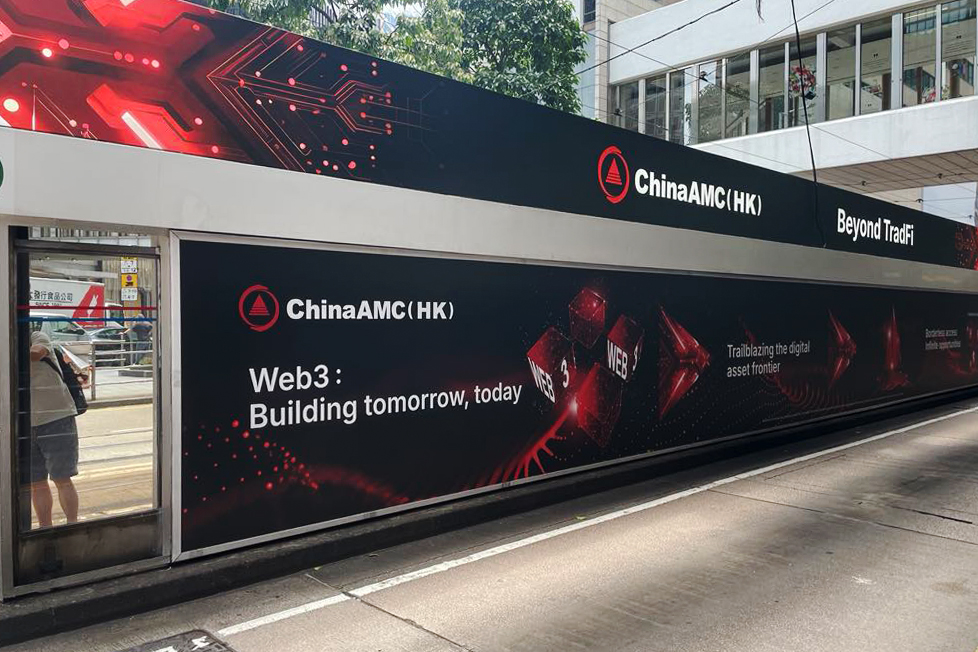

| Few things are as hot as stablecoins right now (save for meme stocks) and the party may just be getting started. The total market value of crypto assets surged past $4 trillion for the first time this month, propelled by the US enacting sweeping legislation to regulate the sector as Bitcoin goes from record to record. The tide may even be turning in China, which has long been skeptical of the asset class. Amid all this, Hong Kong is looking to secure its place in the crypto galaxy. With legislation aimed at expanding the regulatory framework working its way through the political system, companies are already frantically positioning to take advantage of the moment. There's been furious activity across the city, with as many as 50 companies looking to apply for licenses to issue stablecoins starting next month, more than five times the amount authorities plan to hand out. The spike of interest was apparent at a digital finance forum this month, where a stablecoin roundtable drew a full house, with Hong Kong's new law on the asset class going into effect on Aug. 1.  Turn up for crypto. Source: Deloitte The biggest state-owned Chinese brokerages — smarting from their equity capital market misses — are leading the charge, including Guotai Junan, which saw its shares jump 300% in a week on the news that its banking license was last month extended to include digital assets. ChinaAMC, one of the biggest asset managers, launched a tokenized yuan money market fund that allows subscription by stablecoins — months before the first stablecoin was even issued. Right now the money-market fund, in its Hong Kong dollar, US dollar and yuan versions, takes subscriptions in traditional currencies. Hong Kong, with its deep financial industry, history of innovation and traditional role as a gateway between China and global markets, sees itself in prime position to quickly build out a crypto ecosystem to the stablecoin universe. "Hong Kong is an international financial center as well as a payment and settlement center," said Rita Liu, the CEO of RD Group, a stablecoin payment platform. "Stablecoins will enhance its dominance and status" in the latter. That's certainly the calculation at ChinaAMC, which is counting on its new product being immediately available to generate yields as soon as the rules change, Gan Tian, the fund manager's Hong Kong CEO, said at a news conference last week. Citic Securities sees potential for "exponential growth" once stablecoins come to the market, said Matthew Chan, head of product and investment solutions. The brokerage is among those launching new stablecoin-accessible money-market funds alongside Guotai Junan, Standard Chartered, Futu and others.  Ready for takeoff. Photographer: Leung Man Hei/Bloomberg Hong Kong in 2022 surprised the market with a pledge to establish a crypto hub, just after China outright banned onshore trading for the asset class. Now the city is offering licenses for exchanges, dealers, custodians and stablecoin issuers. Retail investors have access to exchange-traded funds backed by Bitcoin and Ether, the largest tokens globally, even with a small initial investment. Still, industry pros see little sign that Beijing will reverse its ban, despite a crescendo of internal voices calling for the embrace of stablecoins. Hong Kong will remain a testing ground for greater China for tech firms or state-owned enterprises, Lily King, chief operating officer of crypto custodian Cobo, said at the conference this month. But even if momentum is picking up and progress has been quick by Hong Kong standards, for the crypto community, it is still a glacial pace.  Moving at ding ding pace. Photographer: Balazs Penz/Bloomberg For now, the HKMA is running a regulatory sandbox for stablecoin issuers to test use cases in a limited fashion. So far, it has onboarded only three participants, including a unit of RD Group. The securities regulator is doing consultations on virtual asset dealing and custodianship, which normally take months to reach conclusions. And just what form of stablecoins will hit the market remains a question. A potential yuan peg has generated excitement and regulators often favor tokens tied to local currencies, RD Group's Liu said. But coins tracking the US dollar dominate with a 99% share of the $263 billion global market, according to DefiLlama data. It's unclear which locally issued stablecoin can stand out and how scalable each one will be, according to Kennix Chan, a vice president at Victory Securities, which is in touch with five stablecoin issuer hopefuls to offer distribution services. What does seem clear, though, is that Hong Kong's ability to capitalize on the momentum will be decided very soon. —Kiuyan Wong |

No comments