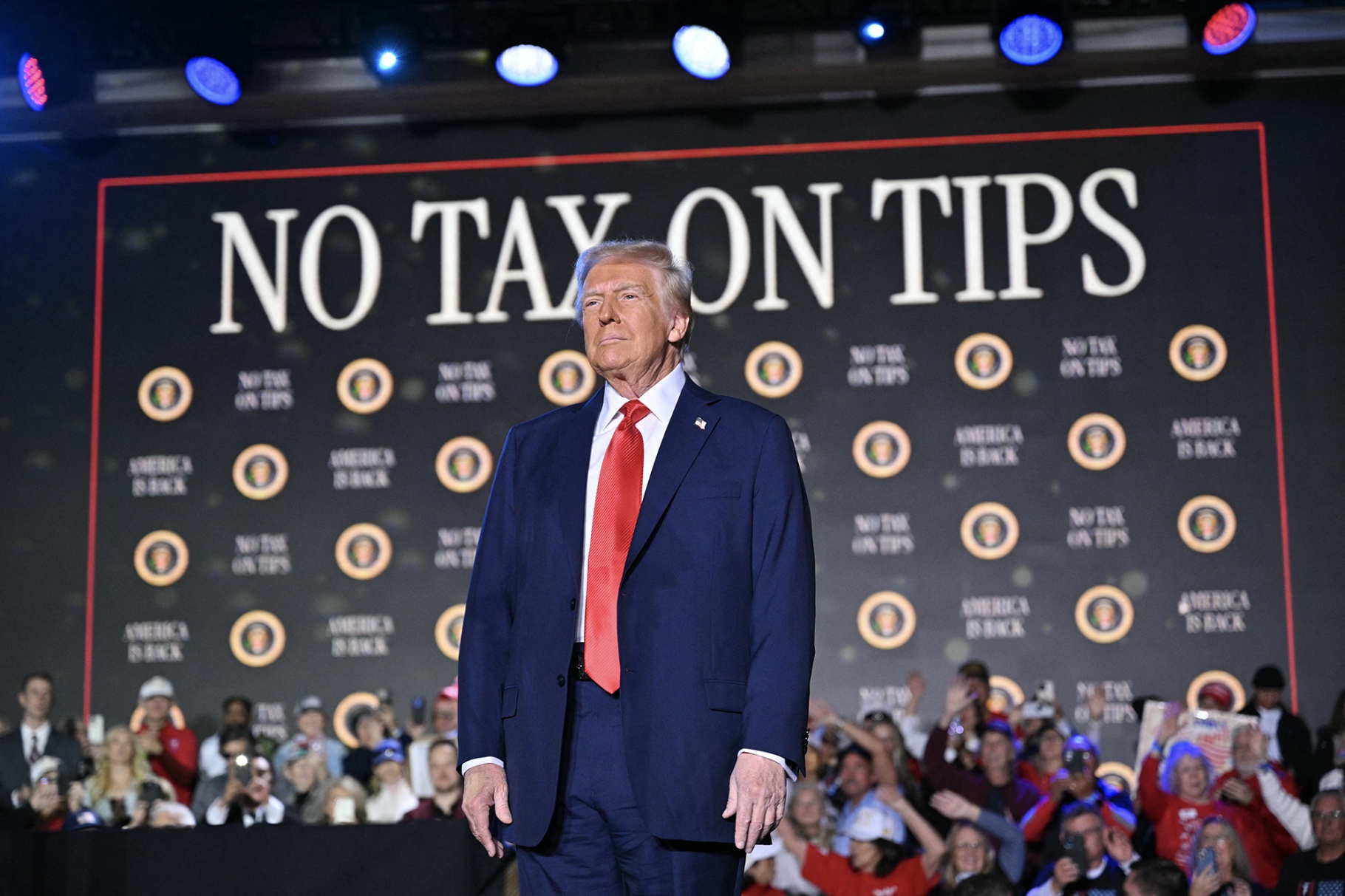

| Tucked inside the "big, beautiful bill" of President Donald Trump's legislative priorities are details about fulfilling his pledge to end taxes on tips and overtime pay. Many workers may be disappointed, Ben Steverman writes. Plus: South Korea's nuclear energy opportunity, and a convention for thrift-store lovers. If this email was forwarded to you, click here to sign up. As a slogan, it's hard to beat "no tax on tips." When a waitress uttered those four words to President Donald Trump last year, he said he instantly replied: "You just won the election for me." The phrase, along with "no tax on overtime," soon became key parts of his campaign's pitch to working-class voters. Now the trick is turning slogans into tax legislation. When Republican lawmakers this week released their first, 389-page draft of a bill that could take months to become law, there they were on pages 23 and 32, respectively: sections titled "No Tax on Tips" and "No Tax on Overtime." And each made instantly clear that American workers are still going to pay plenty of taxes on their tips and overtime. Early versions of the proposals were vague—for example, suggesting that anyone including investment bankers and lawyers might start earning income in gratuities as a way to reduce their tax burden. That was never likely, and indeed the legislation limits tax-free tips to occupations that "traditionally and customarily" receive them. (The Treasury secretary will need to come up with a list.) Also barred from both breaks are employees designated as "highly compensated," an income threshold of $160,000 or more in 2025.  Trump spoke about his policy to end tax on tips in Las Vegas soon after his inauguration. Photographer: Mandel Ngan/AFP/Getty Images Another big limit: The federal government collected $1.7 trillion in payroll taxes and $2.4 trillion in individual income taxes in the 2024 fiscal year. Working-class Americans pay far more into the first category than the second, yet the proposed carve-outs for tips and overtime apply to only income taxes, not payroll taxes. That makes the tax breaks far less lucrative, while rendering them useless for those who pay no income taxes at all—including, according to the Budget Lab at Yale, 37% of tipped workers. Americans might try to squeeze more savings out of the provisions by creatively maximizing their tips and overtime. Accountants and tax experts say overtime seems easier to manipulate than tips, by tweaking schedules. "There will definitely be ways that employees maximize their benefits," says Miklos Ringbauer, a certified public accountant based in Los Angeles and Orange County, California. In the end, the Joint Committee on Taxation estimates, the tip provision will deliver about $40 billion in tax relief over four years. The overtime break saves workers more, $124 billion, but still a fraction of the House tax bill's $4 trillion cost. A pleasant surprise for those who are eligible is that the tax breaks would start right away, in 2025. The bad news is that they're scheduled to last only four years, expiring at the end of 2028 while other provisions are permanent. It's a strategy to control costs, according to Rohit Kumar, national tax office co-leader at PricewaterhouseCoopers LLP. "If they're super popular, whoever's running for president in 2028 can run on renewing them." Polls suggest the slogans were popular. But that will be tested if Trump's campaign promises become law. Sooner or later, many Americans who are excited for tax-free tips and overtime will realize they're not eligible. Then there's the rest of us. Tipped occupations make up less than 3% of the workforce, the Budget Lab at Yale estimates, while 8% of hourly and 4% of salaried employees regularly earn overtime. That leaves hundreds of millions of low- and middle-income workers who might resent paying higher tax rates than neighbors earning the same amounts of income. |

No comments