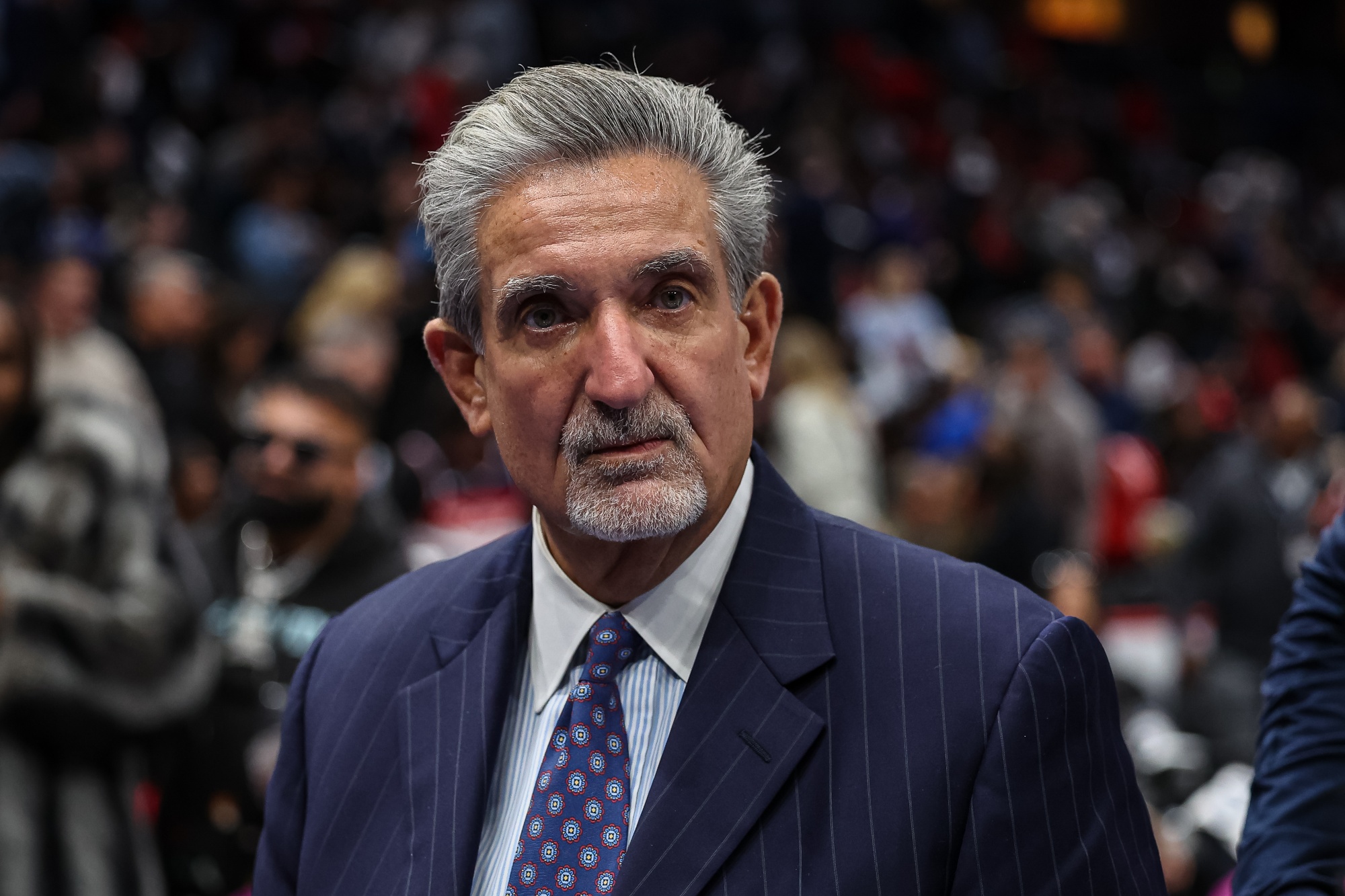

| Hi, it's Vanessa. The WNBA season is getting ready to start this weekend with the anticipated return of league phenoms Caitlin Clark and Ellie the Elephant back on screens regularly. It will also be the first season for expansion franchise the Golden State Valkyries, the first new team since 2008. Last year, the league experienced unprecedented growth on the back of Clark. More fans means franchises have to work out whether to look for bigger stadiums, or leave money on the table. So far, upsizing has mostly happened for games against Caitlin Clark's Indiana Fever, but also against other young stars Angel Reese and her Chicago Sky and Wilson's Las Vegas Aces.  Ted Leonsis Photographer: Scott Taetsch/Getty Images North America Some teams aren't necessarily able to keep up with the demand for more tickets. We spoke with Washington Mystics owner and CEO of Monumental Sports and Entertainment Ted Leonsis about the rise in popularity in the WNBA, and what that means for attendances for his team. We also talk about his idea for a year-long sports pass. Leonsis has long made it clear that he still wants to add Major League Baseball's Nationals to his collection of Washington sports franchises. The Mystics are locked into a deal to continue to play in CareFirst Arena until 2037, which only holds a capacity of 4,000. How do you grow revenue when you're stuck in a smaller venue?

Well, short term and there's nothing I can do about it. And we right sized those buildings for what the reality of the attendance was. We were playing in a 20,000 seat building and selling 1500 to 2000 seats. It's very expensive to run the building and open it up and then you lose revenues when you don't have the dates and you can have a Bruce Springsteen concert. So, our goal was always, let's try to have a 5,000ish arena for Monday night games against maybe an opponent that isn't a rival and then use the big building for playoff games, camp days, big games. And that's still the plan. Even though eventually I can see figuring out a way to put some other programming in CareFirst and when we can sell out all of the games in the big building, they would deserve to be in there. I think they'll excel in CareFirst, but it's our aspiration to have 20,000 sellouts for the women and for the men on an ongoing basis. What's the timeline for the new arena? Has anything changed? No, we're ahead kind of ahead of schedule. We broke ground. It's a ton of work that's going on right now. If you came by, the Wizards locker room doesn't exist right now. It's been destroyed. It'll be redone for the next season. It's gonna take three off-seasons basically. We have to rebuild the plane while it's flying. You bought the Mystics in 2005 for $10 million. The Connecticut Sun could sell for over $200 million. Does that valuation feel right for you?

We've gotten better media deals, ticket prices are going up. Once you sell out and then you have a playoff team, your renewals increase. So it's gonna follow the same kind of pattern that the NBA, the NHL have done as great indoor sports. And my bet is that these teams can get to $20 to $25 million in revenue on average [average WNBA team revenue is around $15 million]. And so if you have a 10 times multiple on it, that's how you get to quarter billion dollars.

Monumental Sports is more than just basketball with the Washington Capitals and Monumental Sports Network. You spoke recently about carrying Washington Nationals games on your RSN but only if you owned the team. How likely do you think that is? ESPN announced it's new streaming service and it's $29 a month and they have 46,000 hours of live programming a year. The reason for that is scale. It's expensive to get a subscriber. You don't want them churning off. That's why we bought our RSN and wanted to control our destiny. Just like we want to own the building, you want to control the scheduling destiny. If you only have winter sports or you only have one team and you get someone to subscribe, well when the season ends they're going to cancel. And now you have the great expense of having to get them again. For us, we have two winter programming teams, we have the Capitals and the Wizards and now we have the Mystics. Well the Mystics are 40 games. If you had a baseball team at 160 games and you had basketball and hockey, all of a sudden you're starting to get that scale and you can sell a year round subscription or month to month and people won't be churning out and canceling. So from a business standpoint it makes a lot of sense. You have other teams that are not at scale. If you're part of a bigger organization, a bigger platform, you can grow revenue. I think you'll find there's gonna be lots of mergers or virtual mergers, where they collaborate and find a way to share programming and sell advertising year round, and do a season pass for the hardcore fans. I love baseball, I love basketball, I love hockey, why can't I go to all of those games? Right? Have a season pass. So I think we're gonna have to see that kind of innovation as the media landscape changes. Hi, it's Maddie. I'm looking at the business of triathlons this week and one company's push to appeal to a wider audience. That seems like a tall order because just looking at the events in an Olympic triathlon — often considered the standard distance — is likely intimidating to most people. It starts with a 400 meter swim, followed by a 10 km bike ride and 2.5 km run. London-based Supertri aims to make the sport more accessible even for casual exercisers. It has a range of events, including a supersprint with a 0.37 km swim, 10 km bike and 2.4 mile run.  Alex Yee of Team GB wins the gold medal in in the Men's Individual Triathlon event at the Paris 2024 Olympic Games in Paris Source: Source: Nathan Laine/Bloomberg Supertri is looking to raise $60 million from investors to keep expanding. That includes building out Supertri's pro league that features top triathletes competing on spectator-friendly courses. "Triathlon as a sport has been static since its inception, and has been very much focused on the ultra endurance," Chief Executive Officer Michael D'Hulst said in an interview. "So we created the concept of short endurance, which we believe is very well aligned with modern audiences and how they consume media." Supertri is part of a boom in the participation sports market. Coming out of the pandemic, people looked to improve their health while also looking for in-person social events. That's fueled growth in running clubs and competitions such as Hyrox, a fitness race mixing running and events like sandbag lunges and burpee broad jumps.

"We have proven that we can inspire people to come and participate," D'Hulst said. "We've already integrated 10 events, so now let's put that on steroids and grow from 10 to 50 over the next three years and continue to use that flywheel where we have the TikTok and broadcast moments to reach wider audiences." |

No comments