Tech's great selloff

It started with Warren Buffett. The world-renowned investor's Berkshire Hathaway on Saturday reported it sold a net $75.5 billion worth of stock in the June quarter, including halving its holding in Apple Inc.

By the time Monday rolled around, there were also reports about imminent escalations between Israel and Iran in the Middle East, which mixed with a surging Japanese yen altering the mood in Tokyo and growing doubts about the US economy and how long AI investments will take to pay off.

Many market watchers cited a flight from risk that spurred investors to cash out of stocks that had outperformed like tech. What's less clear to them is how long the current selloff will extend.

Monday delivered historic drops: Taiwan Semiconductor Manufacturing Co. fell by the daily limit of 10% for the first time losing $67 billion in value and dragging Taipei's Taiex to its worst day in 57 years and fellow chipmaker Samsung Electronics Co. was down about as much. Tokyo Electron Ltd. plunged 18.5%, its worst decline since 1982, while SoftBank Group Corp. which has wide exposure to the tech arena lost $15 billion in market value.

There were some warnings about Apple-related stocks, such as its go-to chipmaker TSMC, before the day's opening, but few could have expected the depth and breadth of the selloff. Even crypto wasn't spared, as Bitcoin also dropped by double digits. Nintendo Co., fresh off a set of disappointing earnings, plummeted more than 17%, its worst day since the pre-Switch era of 2016. Every Asian tech stock of any relevance saw its price chart gashed by an ugly straight line down.

"Tech in particular sees some heavy profit-taking with 25% of Taiwan currently locked limit-down," JPMorgan analysts wrote in a note before European markets opened. Taiwan has a significant retail investor community and the analysts raised concern around a potential "wave of retail margin calls."

Another issue raised by some analysts is that Nvidia Corp., the $3 trillion behemoth driving the artificial intelligence boom, was reported to be facing a delay in the release of its next AI chip, Blackwell. The report said that's because of design flaws Blackwell is a complex module that's actually two large chips spliced into one shell, fabricated by TSMC and could push deliveries back by up to three months. Many of Nvidia's supply-chain partners could be affected, and the company itself was trading down 9% in pre-market action on Monday.

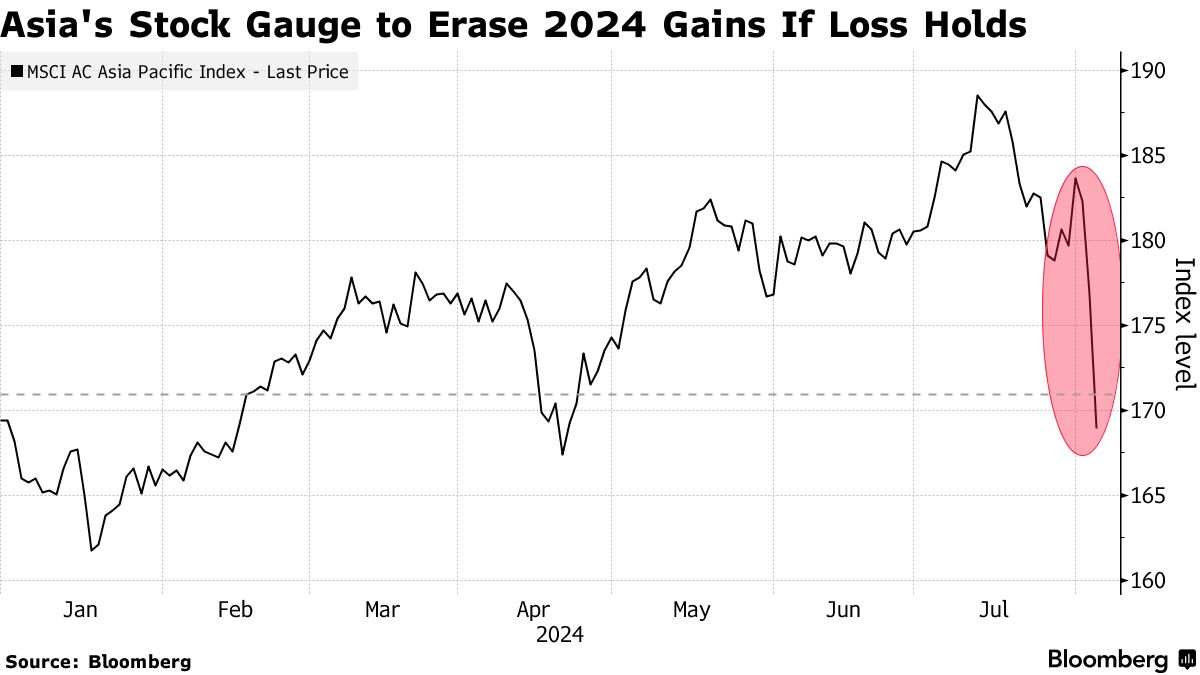

One point of interest is captured in the below chart from our colleagues covering markets: by the end of the trading day Monday, Asia was merely giving up gains from this year. The biggest question now is whether this blistering day of selling was a blip or the beginning of something bigger.

Kyle Rodda, senior market analyst at Capital.com, called Monday's action across the region "panic selling." He attributes the key causes to worries about the US economy and the yen's resurgence forcing the unwinding of carry trades. (Vlad looked up carry trades and found they're a bit of creative interest rate arbitrage, which has turned historically risky with the elevated volatility of the yen).

Narrowing the issue down to the tech sector, the above question may be rephrased as, is there an AI bubble about to burst? An analyst we spoke to in Taiwan, who asked not to be named in order to speak freely, said there's no logical analysis for the real demand for AI. Sure, the huge cloud operators like Alphabet Inc.'s Google and Microsoft Corp. may keep spending on AI data centers, but they can just as easily decide to cut back on capex.

Still, that analyst sees TSMC as an extremely attractive proposition and expects many investors and hedge funds are sitting on the sidelines waiting for the share price to soften a little more anticipating the aforementioned margin squeeze of retail investors before jumping in.

How Nvidia and its US peers trade today will be closely watched. Early indications are that there'll be pain in American markets much like in Asia, though the volatility in tech stocks of recent times has been such that we wouldn't want to guess about what happens beyond today. Vlad Savov and Jane Lanhee Lee.

No comments