| This is Bloomberg Opinion Today, a ready-to-rumble romp through Bloomberg Opinion's opinions. Sign up here. The Millionaire Monk of Shaolin | Monks and clerics have wielded huge wealth and power across the world and over the ages. Europe had its plutocrat popes, of course; but the monasteries of England were so rich that they proved to be a temptation Henry VIII could not resist, and he plundered them in the wake of his divorce from Catherine of Aragon (and the Roman Catholic Church). In Japan, the Tendai school of Buddhism was so powerful that it split into two enormously influential monasteries — Enryaku-ji and Mii-dera — both in the vicinity of the old capital Kyoto. The two institutions often sent warrior monks to settle scores against each other.

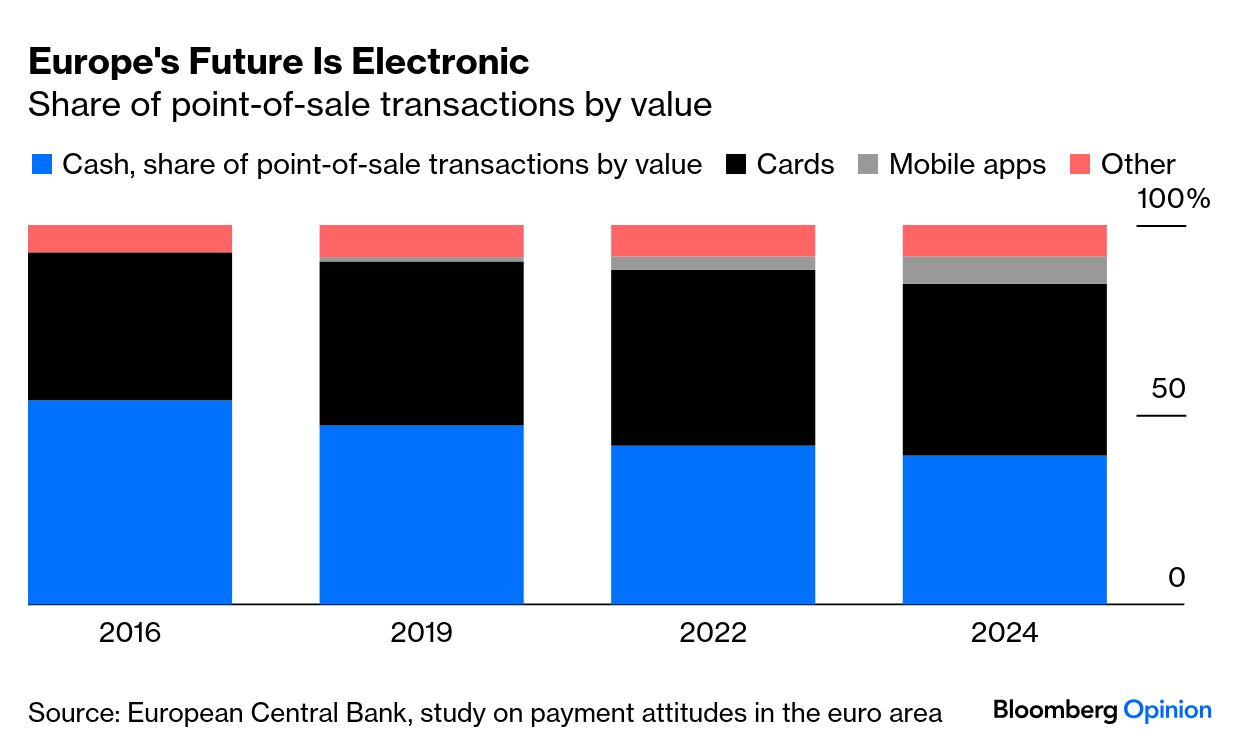

The Shaolin Temple in China's Henan province is famous for its kung fu fighting Zen priests. But it languished in the years just after the cataclysmic Cultural Revolution that saw most of the country's historic legacy assaulted if not demolished. That Shaolin is once again a thriving religious and commercial enterprise, branded globally, is mainly due to Shi Yongxin, who became abbot of the monastery in 1999. But he's in the news now for something different. As Shuli Ren summarizes, Shi is being investigated "on suspicions of embezzlement, maintaining 'improper relations' with women, and fathering at least one child. Companies linked to Shi, nicknamed the 'CEO monk,' were deregistered and his Buddhist credentials revoked." Still, says Shuli, "What's wrong with having an earthly abbot? In modern corporate finance terms, Shi is a management monk, who takes the issue of money off the table so his colleagues can focus on more ethereal things, such as meditation and kung fu practice, which require focus and concentration." And vows of celibacy have never stopped monks from promoting their causes, in any culture and in any age. Shuli thinks something else is in the air. After all, Shi saw some controversy about a decade ago but survived. He may just have become too financially successful. The Communist Party that rules China has always been suspicious of any entity that tries to own too much of anything. And it can turn on a whim. (Compare it to Nvidia's Jensen Huang who was the toast of Beijing two weeks ago but whose company has suddenly been asked to clarify alleged security risks with the chips Washington has finally allowed it to sell to the People's Republic). Says Shuli: "In the early 1980s, intent on opening up and reforming the economy, Beijing hurriedly passed regulations that gave private citizens and non-profit entities room to experiment and explore capitalism. Decades later, loopholes are starting to bubble up." It may not end at the temple. Turning on a Whim, Taipei Edition | When Washington seemed intent on confronting Beijing, Taiwan seemed to be secure in its undeclared independence. China claims the island, but the US has always signaled it may use military means to fend off any forcible attempt to retake the territory. Well, that was a brief respite. Taiwan President Lai Ching-te now has even less room to maneuver. The Trump administration is choosing to de-prioritize him and his confrontation with the mainland. Karishma Vaswani says that not only has the US threatened Taipei with a 32% tariff, it has prevented Lai from making a stopover in the US. Meanwhile, Lai's ham-handed attempt to wrest a majority in the legislature — with a massive recall campaign against some two dozen opposition politicians — was a humiliating failure. If given half-a-chance, fellow members of his Democratic Progressive Party would declare independence — which would almost certainly compel China to invade. Lai will try to unseat seven more opponents next month, but, says Karishma, his attempt to upend the status quo with Beijing isn't popular enough. She writes: "The results of the recall campaign are instructive. Voters want stability in cross-strait relations, not an escalation. Lai needs to listen to them." In the meantime, he has to worry about the winds of whimsy in Washington as it waltzes with China trade and tariffs. As Hal Brands writes, Xi Jinping could "push Trump to further weaken US support for Taiwan as the price of keeping Sino-American diplomacy on track." "For several years, the [European Central Bank] has been preparing to issue what it calls the digital euro. Like a bank note, it would be central bank money, transferable by its holder to anyone at will, with no verification of sufficient funds required. … The mere existence of a central-bank digital currency — exchangeable for private money — would be stabilizing, even if hardly anyone used it. Beyond that, it would have many potential advantages. It could allow for emergency transfers to the vulnerable during crises like the Covid-19 pandemic. If connected to other central-bank digital currencies, it could significantly reduce the cost and complication of cross-border payments, including remittances. " — The Editorial Board in "Who Needs a Digital Euro? Everyone Who Uses Money."  "Do US tariffs spell the end of the Adidas Samba's winning streak? Adidas AG, which has transformed the humble three-striped sneaker into a global phenomenon, on Wednesday reported weaker-than-expected sales growth in the three months to June 30, triggering a 10% decline in its shares. That echoes the bleak performance at fellow German sportswear maker Puma SE, which dropped as much as 21% last week after warning of lackluster demand, as well as the financial cost of US levies that it estimates will wipe about €80 million ($92 million) off gross profit this year." — Andrea Felsted in "Adidas' Samba and Puma's Speedcat Are Slowing Down." The cringey FTSE 100 succession drama. — Chris Hughes The milestone climate ruling that wasn't. — Lara Williams The limits of Palestinian diplomatic recognition. — Marc Champion Pornhub's to blame for Britain's internet mess. — Parmy Olson How Bitcoin is eating the poor. — David Fickling Walk of the Town: The Ghosts of Whitechapel | A couple of months ago, I found myself in Whitechapel after midnight for an emergency appendectomy. Fully recovered (I hope), I decided to wander by the Royal London Hospital, where I had the procedure, to see what it looked like in daylight. The original pre-Victorian facade of the facility still stands, but it is now part of the town hall of Tower Hamlets, the London borough that Whitechapel is now a part of. The hospital is in an expansive block — of glass, brick and labyrinthine passages — behind its previous frontage. August has a couple of uncanny anniversaries for Whitechapel, events that helped define Victorian England and remain emblematic of London.

The end of the month marks the start of the horrific 1888 murder spree by the serial killer known as Jack the Ripper. All but one of the five butcheries of women he carried out took place in Whitechapel. The exception was the third, that of Catherine Eddowes, which happened on the edge of the district and technically within the borders of the City of London. In any case, she is remembered in a plaque not far from where her body was found in Mitre Square. Jack was never apprehended, an invisible monster who blended into the anonymity of the city.  Catherine Eddowes memorial in Mitre Square. Photograph by Howard Chua-Eoan/Bloomberg August 5, 1862, was the day Joseph Merrick was born. At the end of 1884, he was brought to Whitechapel to be exhibited as entertainment at the rear of a building that still stands (it now sells saris and gold jewelry). Merrick was already a public figure in his native Leicester; he was afflicted with the Proteus disease that disfigured his appearance with skin abnormalities, so he was billed as "half-man, half-elephant" for paying gawkers. But he was no monster. He'd end letters with this line of poetry: "'Tis true my form is something odd, but blaming me is blaming God. Could I create myself anew, I would not fail in pleasing you."  Where Merrick was on show, across from the old facade of Royal London Hospital. Photograph by Howard Chua-Eoan/Bloomberg After his manager robbed him of half his savings, Merrick lived out his days at Royal London Hospital, which was just across the street from the Whitechapel shop where he was put on exhibition. In the 20th century, his life would be the basis of a play and a movie, both entitled The Elephant Man. In the stage version, the Merrick character utters these poignant and painful words: "I sometimes think my head is so large because it is so full of dreams." In May, a film adaptation of the play was announced. The title role has gone to Adam Pearson, whose skin has overgrowths caused by neurofibromatosis. A summons for the resemblance of things past ...  "Dear Sir or Madam: You are a rat and have no claim on Labubu earnings. We will see you in court." Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send pro bono assistance and feedback to Howard Chua-Eoan at [email protected]. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |

No comments