| Alan Joyce, who quit as Qantas CEO in 2023 after a flood of passenger complaints, illegal firings and concerns from the competition watchdog, defended his record in Sydney yesterday — and indicated he may yet return to aviation.

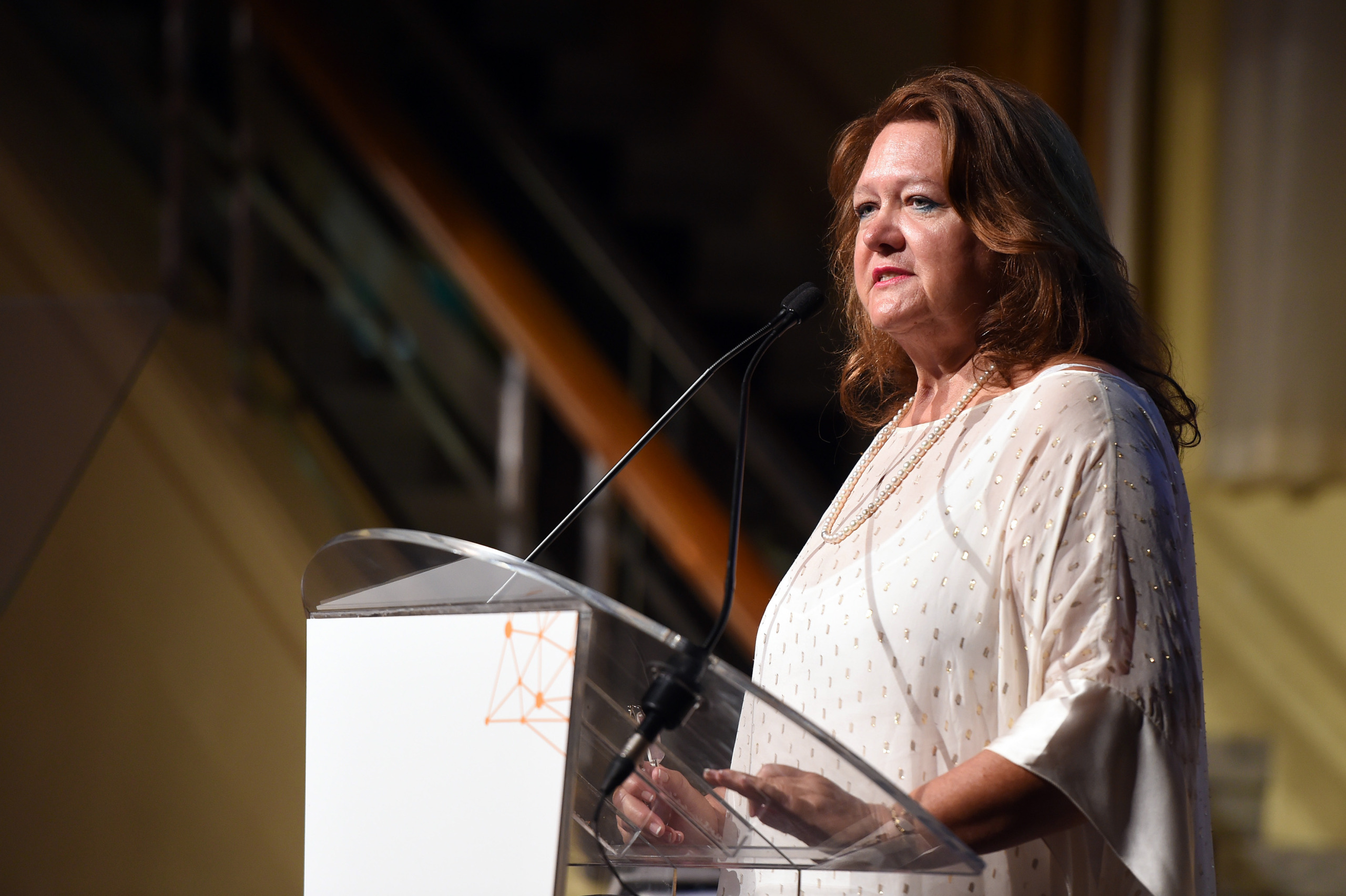

Gina Rinehart, Australia's richest person, saw her US stock portfolio increase in value by more than $600 million in the second quarter, as she boosted her bet on US President Donald Trump's social media platform Truth Social.  Even richer. Photographer: Carla Gottgens/ Australia's jobless rate ticked lower and employment rose, reinforcing the Reserve Bank's cautious approach to policy easing. Meanwhile, a new report from the central bank found that declining business competition is hurting the economy. New Zealand may be just weeks away from deciding whether to loosen a ban on foreigners buying houses, Finance Minister Nicola Willis said in an interview with Bloomberg Television Thursday in New York. This week on the Bloomberg Australia Podcast, host Rebecca Jones speaks to agriculture reporter Ben Westcott about the end of the US beef ban ,and what more American meat in Australia means for local producers. Listen and follow The Bloomberg Australia Podcast on Apple, Spotify, on YouTube, or wherever you get your podcasts. Terminal clients: Run {NSUB AUPOD <GO>} on your desktop to subscribe. ASX shares declined after the company said costs will rise as mounting regulatory scrutiny weighs on the exchange. Total expenses are expected to grow between 14% and 19% in the fiscal year to June 30, according to a statement Thursday.

Sydney-listed fuel distributor Ampol plans to buy EG Group's Australian service-station business for A$1.1 billion. Meanwhile, Australia's top power retailer Origin Energy expects more households to link home batteries into "virtual power plants". The Australian Securities and Investments Commission is suing A$70 billion pension fund Mercer Super, accusing it of failing to report multiple investigations into serious member services issues. |

No comments