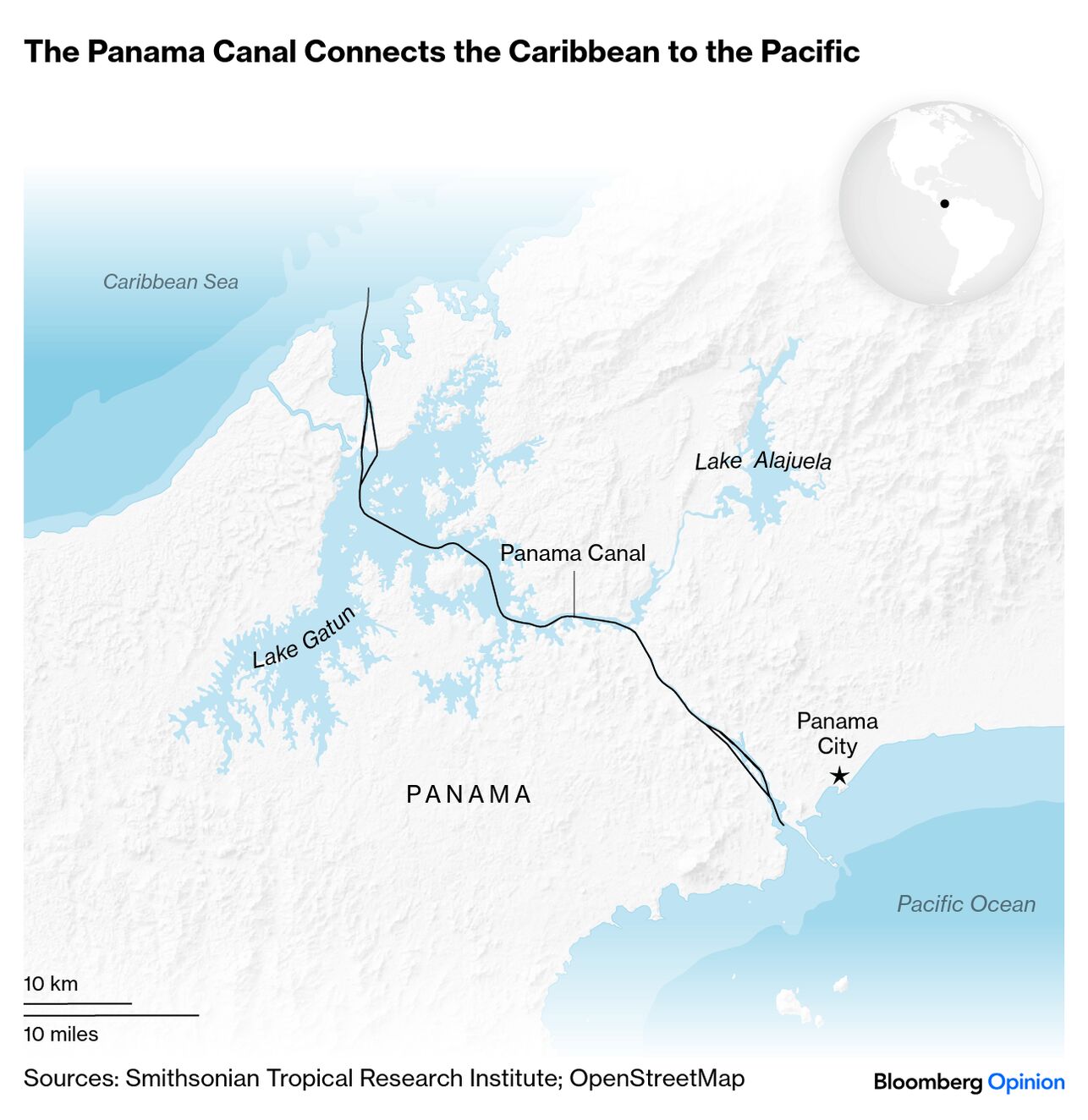

| Here's an insanely niche pop culture fact [1] that you can casually drop at your next dinner party: Luann de Lesseps — AKA "The Countess" from The Real Housewives of New York City — married, had kids with and then divorced a descendant of Ferdinand de Lesseps, the French diplomat who developed the Suez Canal and attempted — key word! — to build the Panama Canal. Why am I telling you this? I fell into an internet rabbit hole after reading Juan Pablo Spinetto's latest feature on Panama, of course. The canal, as you may recall, is a hot topic these days, what with Trump name-dropping the critical trade artery that connects the Caribbean Sea with the Pacific Ocean six times during his joint address to Congress in March and the business world salivating over port deals amidst the global trade war. But Panama, much like Countess Luann, is thrilled to be in the spotlight. "The picture that emerged from my discussions with more than a dozen Panama-watchers, policymakers and business leaders during a recent trip was clear and compelling," writes JP: "If Panama can seize the moment, it has the chance to reinforce the canal's strategic role, attract fresh foreign investment and overhaul its increasingly creaky economic model." The Panama Canal, which is essentially a giant water elevator for cargo boats, Princess cruise ships and military vessels, has a fraught history. You'd think Trump's trade grievances would only add to Panama's troubles, but in an ironic twist, the US president has handed the nation a new lease on life. Business is booming, and JP says the narrow waterway is operating at full capacity as exporters rush to beat the tariffs. "Last year alone, the canal transferred $2.5 billion to Panama's Treasury, or about 8% of the 2025 federal budget. You only need to see the feverish diplomatic action in Panama City, with a constant flow of high-level political visits and quiet, but intense, lobbying to realize the outsized attention that the country is drawing," he writes.  Unsurprisingly, everyone and their mother wants to control Panama's crown jewel because, well, money, power, aura ... you get it. For 25 years, that honor has belonged to Panamanian authorities. "Spend any time there and it's obvious this is not only an engineering marvel — especially since the 2016 expansion added a third set of locks to accommodate the world's largest ships. It's also a commercially successful and efficiently run institution, guided by a deep sense of national stewardship," JP writes. Yet Trump is not pleased to see China's influence creep in. "In 2017, Panama severed diplomatic ties with Taiwan, subsequently becoming the first Latin American country to join China's Belt and Road Initiative; Chinese firms quickly won major infrastructure contracts, including the construction of a $1.4 billion fourth bridge over the canal," he explains. "Beijing clearly saw Panama, a country smaller than South Carolina, as a strategic beachhead for its expansion in Latin American." Enter: the Trump administration. "The US is moving aggressively to curb the Chinese presence. President José Raúl Mulino has made specific efforts to mollify the White House, pulling Panama out of the Belt and Road Initiative, signing a security agreement with Defense Secretary Pete Hegseth and allowing the US military to conduct flashy joint exercises to 'protect' the canal last month." Also included in that partnership: jungle survival and a random piglet. JP says Panama shouldn't let all this newfound popularity go to its head, though. The nation, still reeling from the economic aftershocks of the pandemic, should steer clear of taking sides. "The country's best approach is to position itself as the Western Hemisphere's answer to Singapore, maintaining strong relationships with both superpowers," he concludes. Read the whole thing. And watch this incredible video that JP made during his travels – it's far more enlightening than any trashy reality TV show, I assure you. Bonus Trade Route Reading: The Economy Is Beyond Wack | Sometimes, it seems like Wall Street is living in its own Groundhog Day loop, with headlines saying the same thing about Stocks Hitting a New Record over and over again. The S&P 500 and the Nasdaq 100 hit an all-time high this week? Yeah, sure, that's like saying water is wet. And yet the economy seems to be in a very precarious position: Appearing on Bloomberg Surveillance Wednesday, US Treasury Secretary Scott Bessent made an explicit call for rate cuts, adding to the intense political pressure on the Fed. At the same time, Jonathan Levin says the inflation data from July, showing an uptick in non-housing services, is poking holes in the argument for cuts. John Authers agrees, saying "it's hard to reconcile such rhetoric with the actual numbers." Small business owners are feeling the pain, says Patricia Lopez. "Compared with large companies, smaller enterprises are struggling to wait out the vicissitudes of Trump's on-again, off-again tariffs," she writes. "Investors agree, and publicly traded small companies have seen their stocks become less attractive since Trump unveiled his tariff agenda." Still, Kathryn Anne Edwards says the party is loathe to recognize the coming slowdown brought on by slow job growth, a sad GDP report and hotter-than-desired inflation. "This is a historically dangerous combination," she writes. "There is no nightmare for the modern economy quite like slow growth and rising prices — the dreaded stagflation. And the US is closer to stagflation now than it has been in 40 years." Sooner rather than later, Americans are going to start pointing fingers. Will the White House fall on its sword? Potentially, says David M. Drucker, who mentions an early August YouGov poll for The Economist showing voters are most concerned by "inflation/prices." But that big, beautiful stock market is shielding the president from the worst of the backlash, argues Clive Crook: "Despite warnings of inevitable disaster, the S&P 500 continues to set records, seeming to validate Trump's thinking." Bonus Fedspeak Reading: Significantly shrinking the central bank's balance sheet is the wrong way to lower short-term interest rates. — Bill Dudley |

No comments