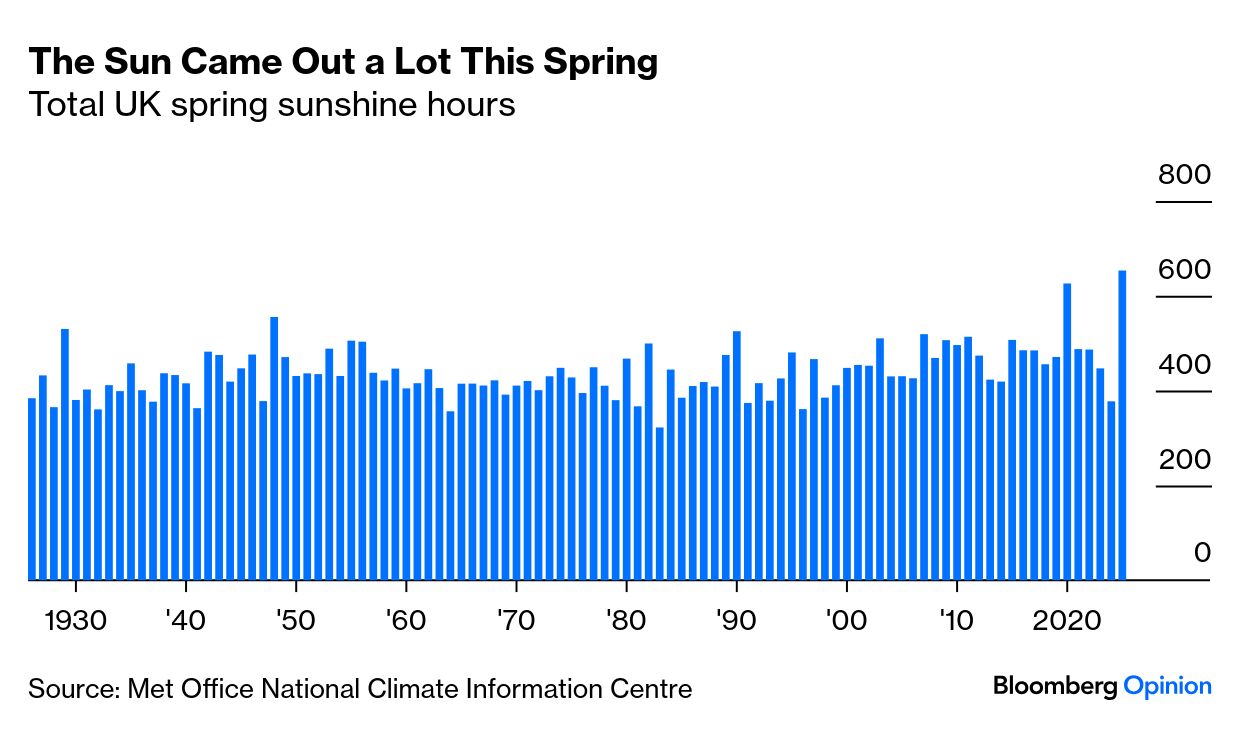

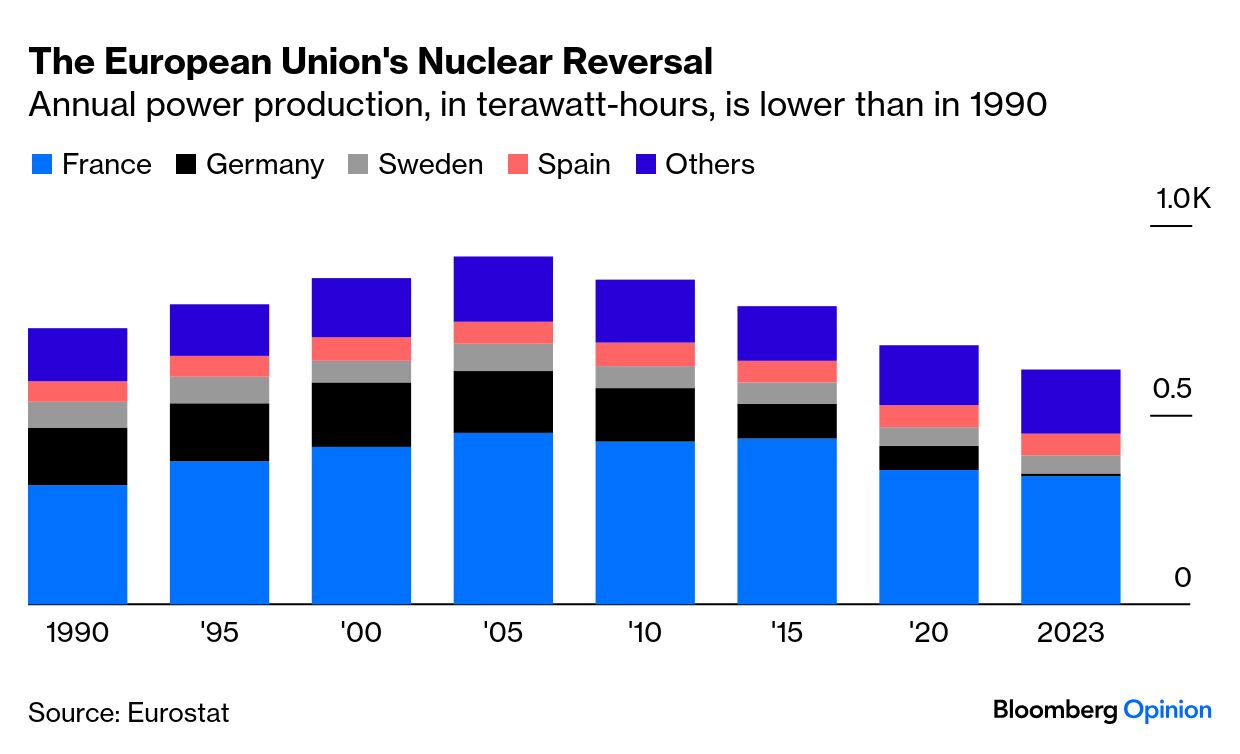

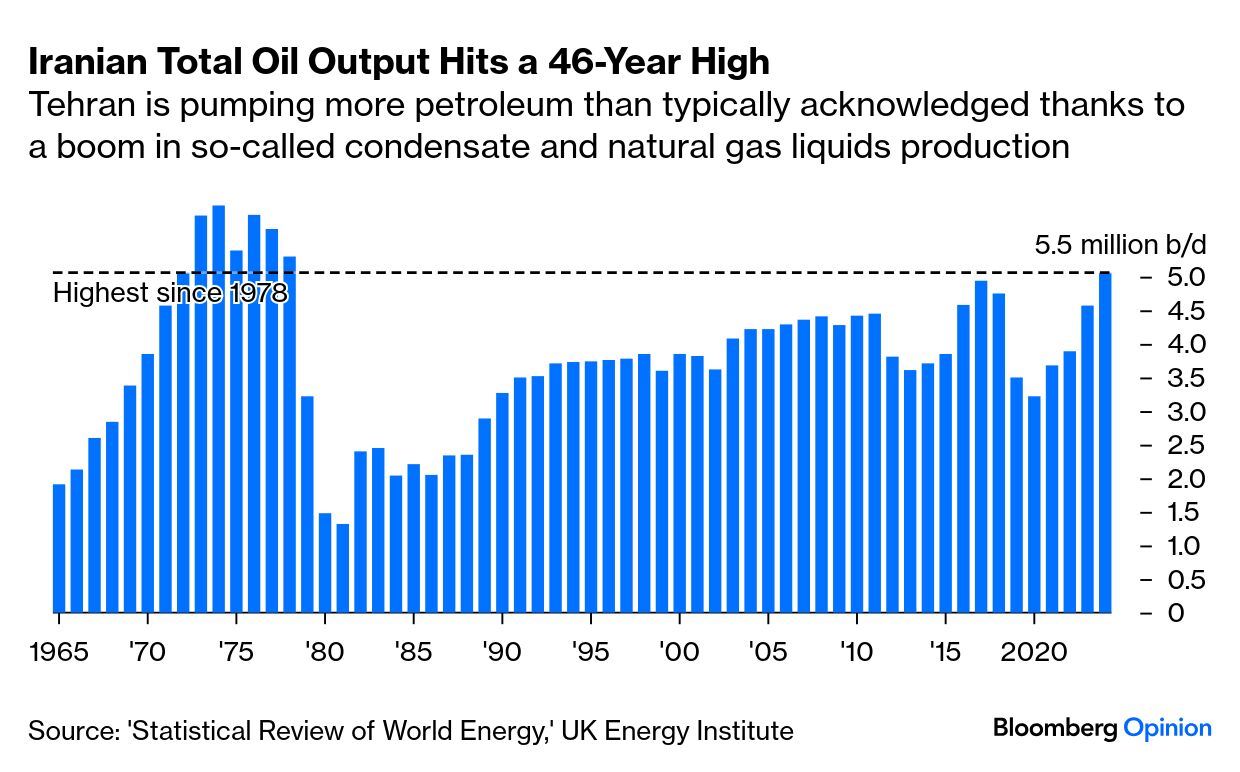

| This is Bloomberg Opinion Today, an offshoot of science fiction that imagines a retro-futurist world of Bloomberg Opinion's opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. Because I work at a serious news organization, the acronym of the week around here has been OBBBA. No, it's not some new Moody's junk-bond rating, or a confused Swedish tribute band. Rather, it stands for the One Big Beautiful Bill Act, a piece of legislation with enough junk to make Michael Milken slaver, and is almost as punishing as watching Eurovision. However, because I am not a particularly serious newsman, my acronym of the week was SSMIS, which isn't a snake with a frog in its throat, but stands for Special Sensor Microwave Imager Sounder, a sort of "x-ray vision for clouds," according to The Atlantic's Zoë Schlanger. And suddenly, it's going blind. "With the SSMIS, forecasters had an autonomous, powerful eye in the sky," Schlanger writes. "But now the Department of Defense says it will cease processing and distributing the crucial imagery from this sensor at the end of this month. Losing these views threatens the National Hurricane Center's ability to see what's forming." While the policy details are as hazy as a London pea-souper, [1] here's the major impact: More uncertainty than usual around my plans to go scuba diving during hurricane season, which may not be the smartest time to hit the Caribbean but is certainly the cheapest. Maybe I should go to Wimbledon instead, as the UK has has just experienced its warmest and sunniest spring since records began in 1884. "This bright weather has produced a series of winners, but it also serves as a reminder that record-breaking extremes come with challenges we need to prepare better for," Lara Williams writes. "Swings between wet and dry weather are becoming more dramatic due to climate change. That volatility makes it hard for multiple sectors to adapt. Even retailers, a clear winner of warm, sunny weather, are having to consider how to deal with climate-induced 'weather whiplash.'"  On the wrong side of the Channel, leaders have fumbled a chance to help stop the swings. "Just a few decades ago, Europe led the world in adopting nuclear. It relied on the technology for more than 30% of its electricity and accounted for more than 40% of global production. But fear of accidents — stoked by the 1986 Chernobyl disaster and the 2011 Fukushima meltdown — drove a reversal," writes the Editorial Board. "The about-face proved to be an epic mistake. Europe forfeited the kind of consistent, inexpensive, low-carbon generating capacity that it now desperately needs. Germany found itself more dependent on coal and imported natural gas than it otherwise would've been — and hence more vulnerable to Russian meddling and volatile gas prices."  On the right side of the Atlantic, we haven't been much smarter. "If you had the power to prevent not just one Great Depression but two, you probably wouldn't hesitate to use it. But for some (not very mysterious) reason, that's pretty much what we do when we ignore an increasingly hot and violent climate," writes Mark Gongloff. "The latest evidence comes from Bloomberg Intelligence, which this week estimated that climate-related disasters have cost the US economy at least $6.6 trillion in higher insurance premiums, cleanup spending and other expenses over the past 12 years. Adjusted for inflation, that makes climate disasters already twice as expensive as the Great Depression's $3.3 trillion in losses over the same time frame." Which brings us back to the GOP's clever plans to explode the national debt, slash taxes, devastate Medicaid and justify it all with fantasyland math. [2] As a genre, Liam Denning thinks the Republicans' approach to climate is less fantasy than steampunk. "This offshoot of science fiction imagines a retro-futurist world where industrial steam power remains the cutting edge; think Jules Verne, zeppelins and Babbage machines," he writes. "The description is all the more apt because the GOP appears to imagine that 19th-century energy sources will underpin US dominance of 21st century fields like artificial intelligence." That nostalgia for the 19th century perhaps explains the Republicans' desire to push more tax breaks for some folks who don't appear particularly needy: Big Oil. "The world's top five oil companies made $102 billion in pure profit in 2024 and the industry was able to return $349 billion to shareholders in dividends and buybacks," writes Mark. "Those handouts also suggest shareholders aren't exactly raring for these oil companies to drill, baby, drill, especially with the long-term demand outlook increasingly uncertain … this is a mature industry that doesn't need the handouts it already gets, much less a shower of new favors." Or a hurricane of them, either. More Hurricane Reading: - Tesla Hit Refresh on Its EVs. It Didn't Work — Liam Denning

- Medicaid Cuts Will Hit Rural America Hard — Lisa Jarvis

- Thom Tillis Knew What the GOP Refused to Hear — Mary Ellen Klas

What's the World Got in Store? - Fed minutes, July 9: Independence Is the Worst Form of Central Banking — John Authers

- Trump trade pause deadline, July 9: US-Led Trade War Threatens a Global Economic Setback — the Editors

- China CPI, July 9: Taking GDP Out of the China Equation — Daniel Moss

There may be no hurricane of petroleum looming, but as Javier Blas puts it: "The world is swimming in oil." And if you paddle far enough upstream, you are going to end up in Iran. "As the debate plays out over the damage done to the Iranian nuclear program by US and Israeli strikes, one reality is clear: The country's booming energy sector, the cash cow of the regime, emerged unscathed. The numbers don't lie. Iranian oil output reached a 46-year high in 2024," Javier writes. "Every time I hear an American official talk about US oil sanctions on Iran, I can't help wonder: 'What sanctions, exactly?'"  Iran didn't create this pool a bubblin' crude alone. "Global oil demand is rising gradually, but ever more of the black stuff is being pumped. Saudi Arabian supply is set to reach a two-year high of 10 million barrels a day as it chafes at its OPEC+ partners exceeding their mandated quotas," add Mark Gilbert and Marcus Ashworth. "Even the conflict between Israel and Iran produced just a short-lived spike in Brent crude that quickly faded, leaving it trading below $70 a barrel. With the OPEC+ cartel agreeing to increase production quotas and prices high enough for US shale producers to have locked in their output, oil prices are only headed one way — down." Which means global temperatures are only headed one way — up. Note: Please send zeppelins and feedback to Tobin Harshaw at [email protected]. |

No comments