| This is Bloomberg Opinion Today, the layoff edition of a broader phenomenon of Bloomberg Opinion's opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. What is the secret of a successful corporate dynasty? Don't look to me for wisdom — I went college with any number of Fords, Firestones and Rockefellers and didn't pick up an iota of business sense. But one thing seems clear: It isn't easy to keep things going from generation to generation to generation. Just ask the Medici, the Guccis, the Tanzis and even some non-Italians like the Eatons, the Sacklers, the Busches and the Freys. By comparison, the Roys are a model of intergenerational comity. But not all family dynasties have an epic collapse, and Adrian Wooldridge has an explanation: They are from Europe (the non-Italian part, apparently.) "The best European family companies have survived everything that history can throw at them — plagues, famines, world wars, recessions, revolutions — and continue to thrive," Adrian writes. "The Henokiens Association, an international club of 57 family businesses that have survived for at least 200 years, includes only 10 non-European members, all Japanese. The British have created their own club, the Tercentenarian Club, of companies that are more than 300 years old." Well, that last bit might seem a tad biased against those of us who live in country only now approaching its 250th birthday, but Adrian's on a roll. "A familiar English proverb suggests that family companies seldom survive more than three generations ('from clogs to clogs in three generations')," he adds. "A glance at corporate actuarial tables suggests that the three-generation rule is generous: The typical life expectancy of any company, family or non-family, is only a couple of decades, and is falling." What explains the longevity of the best European family businesses? Adrian has a few suggestions: - Put the family business first.

- Celebrate tradition.

- Secure a pipeline of talent.

- Focus on justice.

- Provide safety valves.

- Don't flood Appalachia with Oxy.

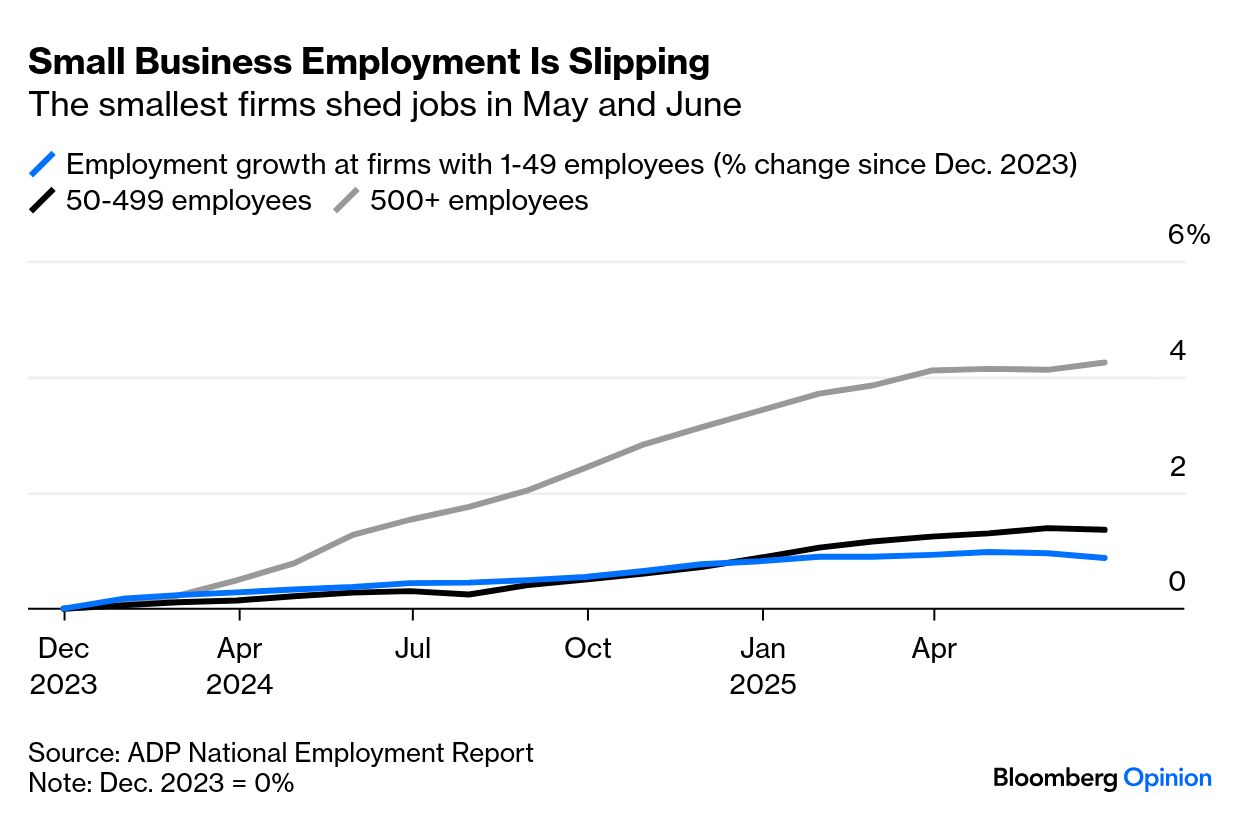

OK, I made that last one up, but you get the idea. And while the bigger they are, the harder they may fall, in the tariff-mad era of Donald Trump, size can act as a kind of insurance. It's the little guy who needs to watch out. "Unlike the publicly traded giants who can often secure a private audience at Mar-a-Lago or at least have officials lobby on their behalf, small businesses have neither the policy influence, the negotiating leverage with suppliers, nor the fat profit margins to weather large cost increases and haphazard policy implementation," writes Jonathan Levin. "So while tariffs and trade uncertainty haven't held back the S&P 500 Index or had an obvious impact (yet) on the consumer price index, one plausible thesis is that small businesses will take the brunt of the blow."  Jonathan notes that small businesses employ about half of America's private employees. As we've established previously, my math skills are poor, but I think that means the other half get their paychecks from the big guys. Either way, the pink slips are piling up: In the first half of the year, US employers let go of nearly 745,000 people, the second-highest number for the period since 2009. Worse, adds Beth Kowitt, companies are shockingly bad at it. Her theory: "Normalizing the practice has ended up sucking the humanity right out of it." "It's the layoff edition of a broader phenomenon I've been following among America's CEOs: The end of the era of corporate do-gooderism and make-the-world-a-better-place discourse," Beth writes. "Empathetic leadership, all the rage during the COVID era, isn't part of the conversation anymore. And the lack of respect that employees have subsequently felt from their employers is accelerating a crisis of trust in big business." One thing Adrian might have added to his list: Bring in a woman as CEO. Samyang Foods Co., the manufacturer of 'Buldak' ramen, has gained 93% this year. Trading at 26 times forward earnings, it boasts $8.1 billion market cap," writes Shuli Ren. "This rally has also made Chief Executive Kim Jung-Soo, who married into a conglomerate family and turned around the instant-noodle company after it declared bankruptcy in the late 1990s, a rare billionaire in her own right in the country's male-dominated business world." In the male-dominated tech world, however, things aren't much changing: Linda Yaccarino resigned as CEO of X after failing at the hopeless task of saving the world's richest man from himself. "Yaccarino, a former NBCUniversal executive, had a surfeit of reasons, both moral and professional, to resign during her two-year tenure," Dave Lee writes. "Musk's torching of one of the world's most famous brand names on a whim one weekend might have been one of them. Musk's decision to tell advertisers to 'go f--- yourself" might have been another." On the subject of jobs nobody should want, consider BP. "It should be one of the most coveted jobs in the City of London: chairing the board of directors of oil company BP Plc. Finding a candidate, though, is proving tricky; the list of people who aren't interested keeps growing. This lack of interest reflects how challenging the gig is," writes Javier Blas. "Robert Horton, who was BP chair for a brief period in the early 1990s before being ousted in a boardroom coup, was rather arrogant about his own merits, but he wasn't wrong about what's needed: 'Because I am blessed by my good brain, I tend to get to the right answer rather quicker and more often than most people.' " Horton lasted all of 27 months at the helm, during which time the stock dropped by nearly 40% . No wonder Adrian kept "good brain" off his list. More Family Affair Reading: What's the World Got in Store ? - FIFA Club World Cup final, July 13: The FIFA Club World Cup's Biggest Enemy Is Its Creator — Adam Minter

- US CPI, July 15: Three Reasons the Fed Will Stand Pat on Interest Rates — Bill Dudley

- China GDP, July 15: Can China Compete in the AI Talent War? — Catherine Thorbecke

Despite this year's spike in corporate firings and pending troubles for small businesses, last week's US jobs report was pretty good: Overall, there was a gain of 147,000 jobs and unemployment dropped a tad to 4.1%. But nobody lives in "overall," especially not Black workers, whose unemployment shot up to 6.8% in June from 6% in May — and from an all-time low of 4.8% in April 2023. What could be driving it? "President Donald Trump's efforts to stamp out diversity, equity and inclusion programs and reduce the federal workforce, in which Black workers are overrepresented, might be playing a role. The decline in Black employment started before he took office, though, which raises suspicion that it could be an early sign of underlying labor market weakness," writes Justin Fox [1] . "When times have been tough for US workers in the past, Black Americans have usually suffered most. They're more likely to get laid off, and less likely to be rehired, than others." But Justin hits on a less obvious factor that may be introducing some noise in the the data: the increasing number of Americans who identify as being in more than one racial category. While these days the Census Bureau asks more open-ended questions about race and ethnicity, the unemployment data categorizes people as only White; Black or African American; American Indian or Alaska Native; Asian; or Native Hawaiian or Other Pacific Islander. "The number of respondents volunteering that they are of two or more races has been growing anyway, and the surveyors are beginning this month to experiment with open-ended questions," Justin reports. "This fading of the lines dividing racial categories is surely a healthy development overall but will make it harder to interpret the labor market statistics for racial groups. Right now, those statistics for Black Americans seem to be pointing to trouble." Note: Please send Buldak ramen and feedback to Tobin Harshaw at [email protected]. |

No comments