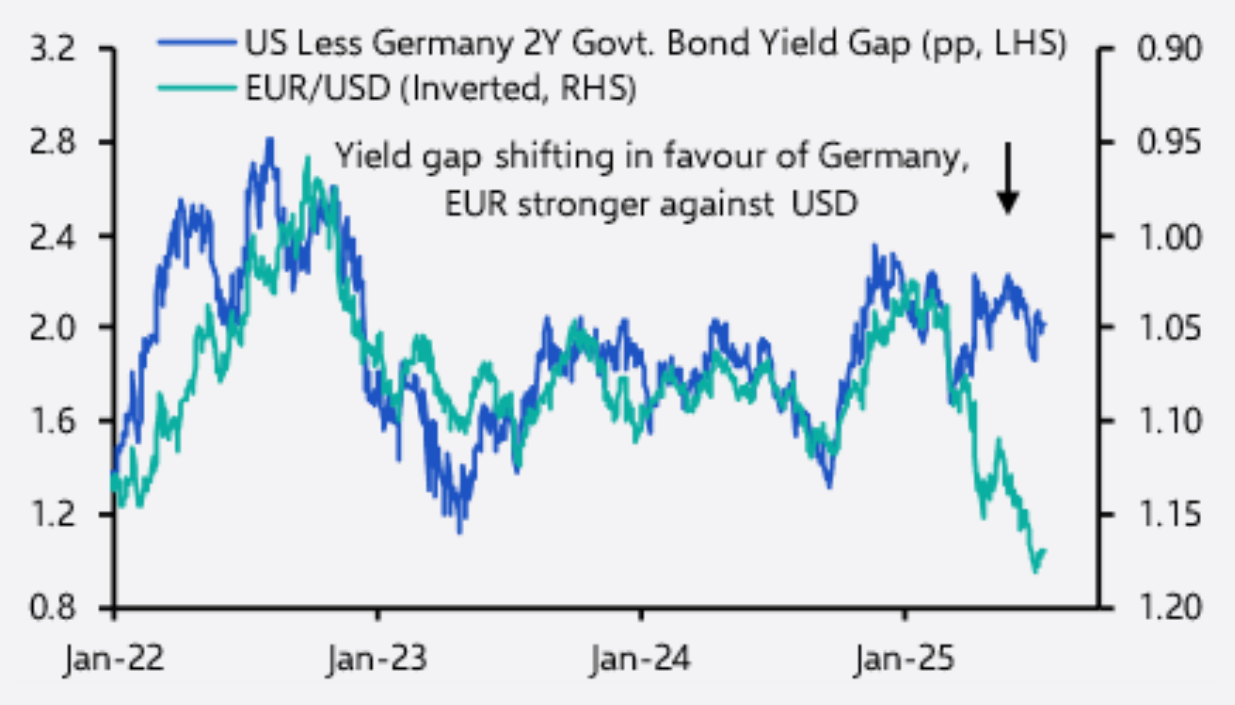

| It's been an exciting 2025 for European markets. The story so far: The aggressive Trump administration provoked the European Union into a big defense buildup, and Germany into a historic expansion of fiscal policy. That generated surprising outperformance for European assets, as investors pondered the possibilities that the EU might finally get its act together, and that the new broom in Washington could destroy American exceptionalism. With the US now threatening 30% tariffs on European goods from next month — higher than threatened on Liberation Day, April 2 — the European revival trade faces its biggest test. This is how large caps have fared compared to US counterparts since the beginning of last year, in dollar terms. The Magnificent Seven tech stocks are excluded: The rebound owes much to the resurgence of the euro. On a trade-weighted basis, it is now its strongest since 2018: This makes European goods less competitive — a problem for an economy heavily dependent on exports. If a weak euro can be regarded as a "non-tariff barrier," this sharp appreciation has knocked it down. Tariffs on top of this would hurt — a lot. The euro is holding on to its gains, even though rate differentials should strengthen the dollar. This was a previously tight relationship that broke down earlier in the year. John Higgins of Capital Economics suggests that if the relationship had held, the euro would be closer to $1.05 rather than its current level of about $1.17:  Source: Capital Economics The strong euro owes much to decisions to hedge dollar exposures as Trump 2.0 took off. It's also driven, as Points of Return has covered, by investment flows. Investors tend to be overweight the US, and any retreat will involve selling dollars and buying euros. Higgins points out that to date this move has had fundamental support. Earnings forecasts for Europe tanked in 2024 and rebounded this year as US expectations stalled. This naturally drives flows toward European stocks. The question is how long this can continue if the EU economy doesn't rebound on cue: Another vital issue is Ukraine. The widespread assumption was that Trump would force a cessation of hostilities, leading to some kind of reconstruction dividend for Europe. That hasn't happened. Trump's announcement that the US will sell weaponry to European NATO allies to pass on to Ukraine suggests that American contractors will share fully in any benefits from the continuing conflict. Excitement around European arms stocks, however, remains phenomenal and has far outstripped US rivals: It takes time to build manufacturing capacity and convert facilities to make new products, but some evidence that the arms buildup is moving ahead as hoped will be needed before long. As it stands, the Bundesbank's index of economic activity shows a persistent fall since the March fiscal and arms announcement. The paradigm-changing move has not yet sparked an economic response: Another effect of a strong euro is renewed deflationary pressure. The post-pandemic inflation shock in the euro zone was very similar to the two energy shocks of the 1970s, driven in this case by the cost of gas in the wake of the Ukraine invasion. Sebastian Becker of Deutsche Bank AG shows that this spike has progressed very similarly to those two episodes, and thus is probably over: A stronger euro makes imports cheaper and reduces inflation, all else equal. European inflation expectations are falling, with 10-year breakevens now below the European Central Bank's 2% target: While breakevens at these levels are not alarming, the balance of risks for the EU has shifted again toward an economic slowdown. That's a problem because a 30% tariff on everything Europe sends to the US would weigh heavily on the economy. Exports to the US benefited from tariff front-running earlier this year, but even accounting for that, they have still grown far faster than Europe-bound US exports: Is Trump serious about 30%? Plainly he wants to negotiate, but the market is taking the latest threats too lightly. David Kostin, US equity strategist at Goldman Sachs, shows that the US stocks most exposed to exports have far outperformed domestic-focused companies ever since Trump announced a 90-day pause on tariffs in April. Stock markets are assuming tariffs are definitively over: For the EU, that's a dangerous assumption. As Jean Ergas of Tigress Financial Partners points out, the new administration regards tariffs on the EU as more than a transaction. "With Europe, these aren't tariffs. These are reparations. This isn't, 'Let's make a deal.' It's, 'You exist to torment me.'" The EU is offering counter-purchases, Ergas says — such as buying more US LNG or arms — but the Trump team wants market access. That involves altering European regulations, for example on food safety, and will be much harder. Some sort of truce and a rate lower than 30% are achievable, but the issue won't go away, and will act as a lead weight on the European economy. If that means lower rates, and dampens European earnings, it will also bring down the euro. The negotiations of the coming weeks promise to be crucial for the common currency. |

No comments