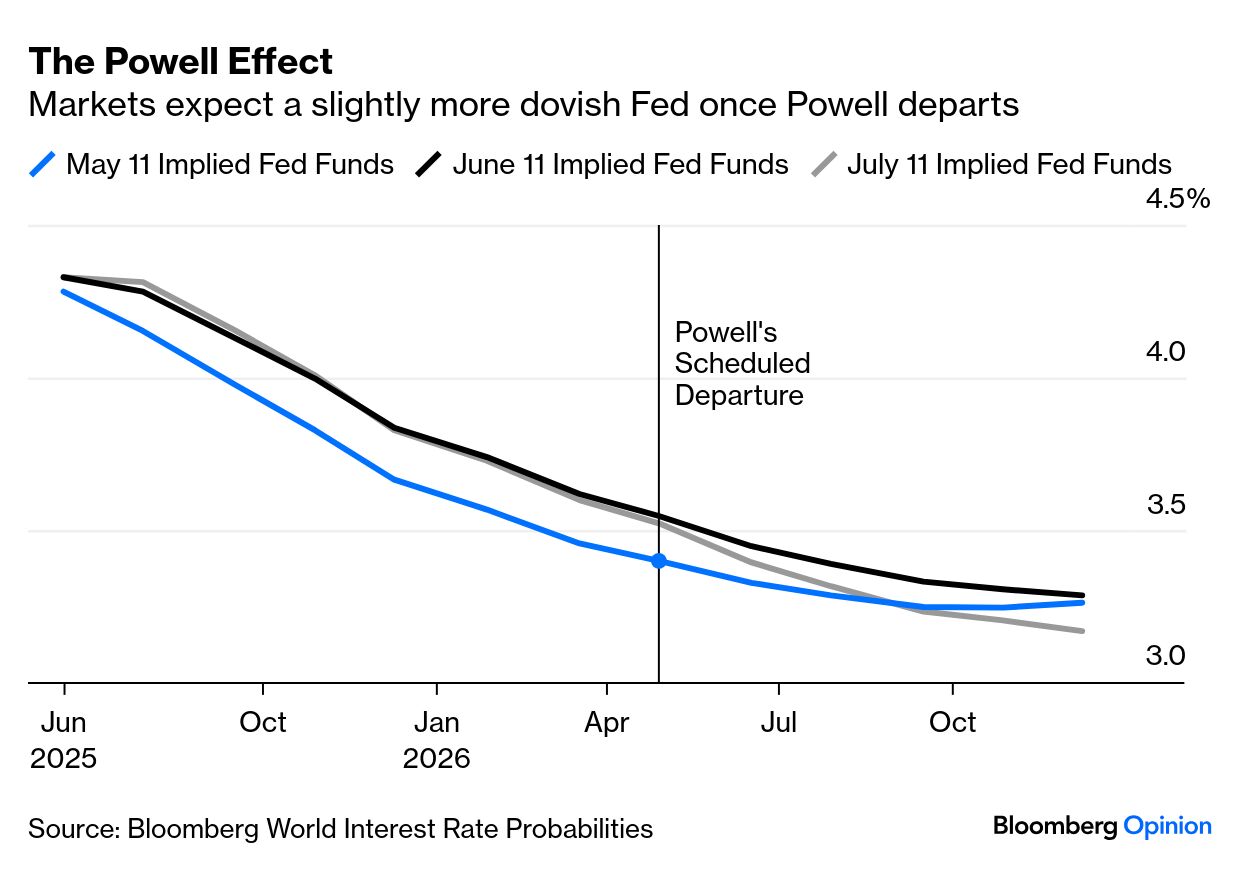

| Search for the word "Powell" on X, as Twitter is now known, and you will swiftly conclude that the chairman of the Federal Reserve is about to resign, before he's fired. The financial markets, and even the prediction markets, still find this a remote possibility. Which should we take seriously? Odds of a departure in 2025 spiked earlier this year on Polymarket and Kalshi when President Donald Trump made an explicit threat to fire Jerome Powell, and subsided a few days later once he said that he had "no intention" of doing so. The tremors of the last few days have left Powell's chances of surviving the year at a little better than 80% on both sites: In more important financial markets, there's no sign that the world's most powerful central banker is about to lose his job. The MOVE index of bond market volatility spiked after the Liberation Day tariffs and the initial threat to fire Powell. It's now at the bottom of its range: The rates market also shows little concern. Powell is under fire for keeping rates too high. Any replacement will have to promise a more dovish monetary policy — and a number of well-qualified candidates did just that last week. But the futures market's projected path of the fed funds rate has barely budged over the last two months. There is a Powell effect, as futures now see a significant easing after Powell's last scheduled meeting as chairman in April — but it isn't pricing in an early departure.  The problem with dismissing the Powell speculation is that the pressure now appears to be a coordinated campaign. The cri de guerre is that he deceived Congress over the expense of renovations to the Fed's headquarters. These arguments are coming not just from the president, but from key allies.

A serious attempt at an ouster is plainly afoot. Bill Pulte, the federal director of housing finance, issued a somewhat sinister statement, saying he was "encouraged by reports that Jerome Powell is considering resigning," while adding: "The patriotic thing for Jerome Powell to do is to resign." Russell Vought, head of the Office of Management and Budget, said Powell had "grossly mismanaged the Fed" and demanded answers within a week to allegations of cost overruns.  The Marriner S. Eccles Federal Reserve building during a renovation in 2023. Photographer: Valerie Plesch/Bloomberg Finding a reason to dismiss Powell "for cause" makes things easier. But it's bound to be interpreted by markets as an attack on central bank independence in order to push rates lower. They will treat it accordingly. That could be serious. To quote George Saravelos, head of FX strategy at Deutsche Bank AG: The empirical and academic evidence on the impact of a loss of central bank independence is fairly clear: in extreme cases, both the currency and the bond market can collapse as inflation expectations move higher, real yields drop and broader risk premia increase on the back of institutional erosion. Interestingly, the impact on equities has been far more ambivalent given they are ultimately a claim on real assets. We would point to the example of rallying equities in Turkey during the unconventional monetary policy period of the CBT.

A Powell exit would be a big shock. Saravelos suggests the DXY dollar index would fall "at least 3% to 4%" in the first 24 hours, while long Treasury yields rose 30 to 40 basis points — a combination usually seen in emerging market crises, and similar to April's response to Liberation Day. These charts show what those predictions would entail. The 10-year yield would come back to challenge its 2023 high, while the dollar would drop to a four-year low. Big moves but not a paradigm shift: Ten-year yields back close to 5% are exactly what the administration doesn't want, but exactly what it would deserve for a naked politicization of its central bank. Equities could be different. Longer yields would rise, but shorter term rates would fall with a new dove at the Fed. That should help equities in the short run, as this chart from Absolute Strategy Research makes clear: Ian Harnett of Absolute Strategy suggests that the stock market would get through this, as all the potential replacement candidates are "more than credible." In the short run, they would likely add liquidity when conditions are already very stimulative (even if the administration desperately wants lower rates). There are further issues. Powell might resign as chairman but maintain his seat as governor for another two years. The Fed's regional governors might take a strong line against any new attempt at dovishness. All of them have voted in line with Powell over the last year, and their response could be critical. This remains a dumb risk that doesn't need to be taken. Powell oversaw a terrible policy mistake in 2021, but at present he's presiding over declining inflation and low unemployment. There's little upside to getting rid of him, while the downside is cavernous. Investors can see this, which is presumably why this extreme risk isn't being priced, but it's not clear the president does. In trade news, goods from Mexico and the EU will be subject to a 30% US tariff as of Aug. 1. This came after markets closed Friday, and on its face is shocking. Both are huge trading partners. Mexico has a long-standing treaty in force, while the EU wants a deal and has been trying to make one. It's also clear, however, that the president feels particular resentment toward both, and believes they have done wrong by the US. That's a terrible reason to impose tariffs. It's not a good reason for investors to ignore them, but that's what they're doing. These announcements and others last week were worse than reasonable baseline expectations, yet their effect on equity indexes was minimal. The euro and peso barely moved in early Monday trading: The case to ignore these tariffs is that they appear impulsive, and there is already a strong history of delays and reversals. But the fact remains that tariffs as of Aug. 2 stand to be slightly higher than those announced on April 2, Liberation Day. That event provoked a dramatic market selloff. The calm this time suggests complacency. Peter Tchir of Academy Securities said: A president who has had several big recent wins, truly believes in tariffs, and cannot like the TACO meme, may be far more serious about this than is currently getting priced in. With those other big wins under the belt, the market should not respond as poorly as it did the first go around, but a pullback of 5% would seem highly likely as we near Aug. 1 without any major reprieve.

A further problem is what George Soros calls reflexivity. The market's calm reaction appears to be feeding in to the president's decisions. Announcing Canada's 35% tariff last Thursday, he told NBC: We're just going to say all of the remaining countries are going to pay, whether it's 20% or 15%. We'll work that out now. I think the tariffs have been very well-received. The stock market hit a new high today.

While the market works on the assumption that the tariffs will be withdrawn, so they make it that much less likely that they will be withdrawn. At some point, these two versions of reality will at last come into conflict. |

No comments