Tokens of AI themed blockchains like Near Protocol

The artificial-intelligence trade in crypto has morphed into a widow-maker after

powering outsized gains earlier in the year, a stark contrast to the ongoing

resilience of the investment theme in the equity market.

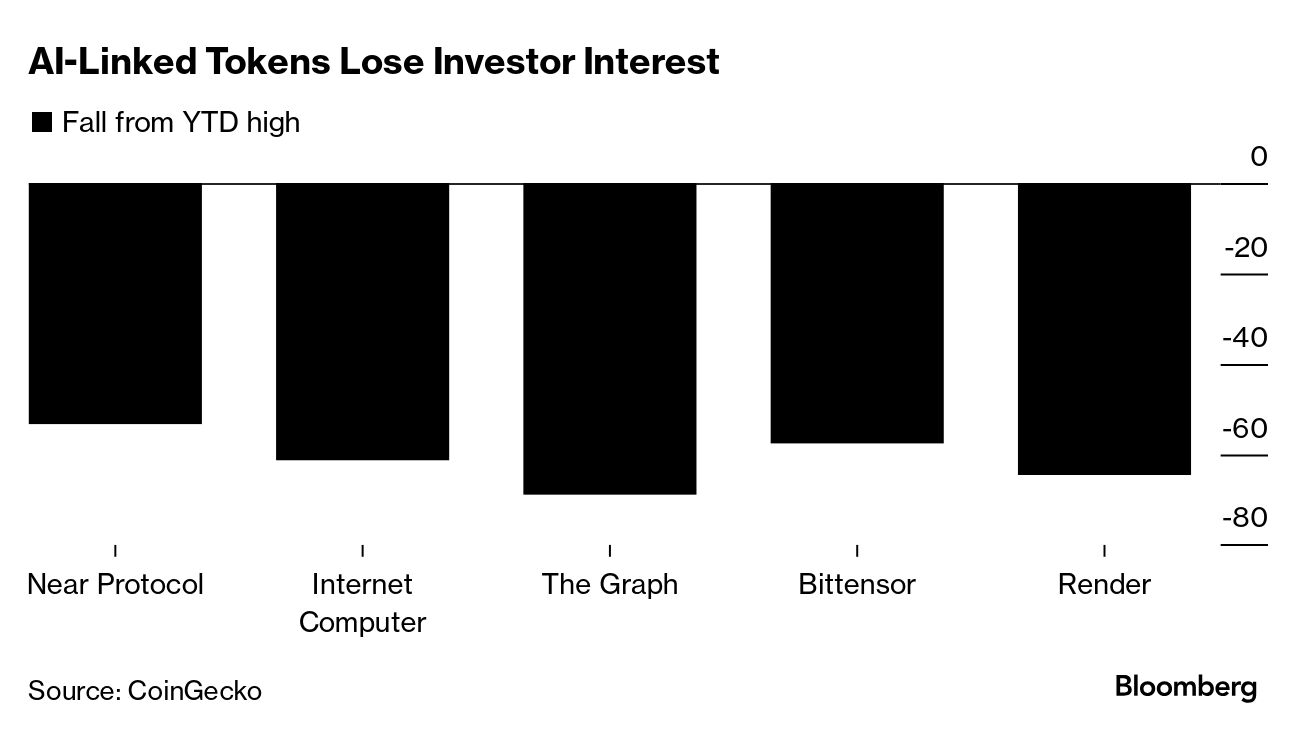

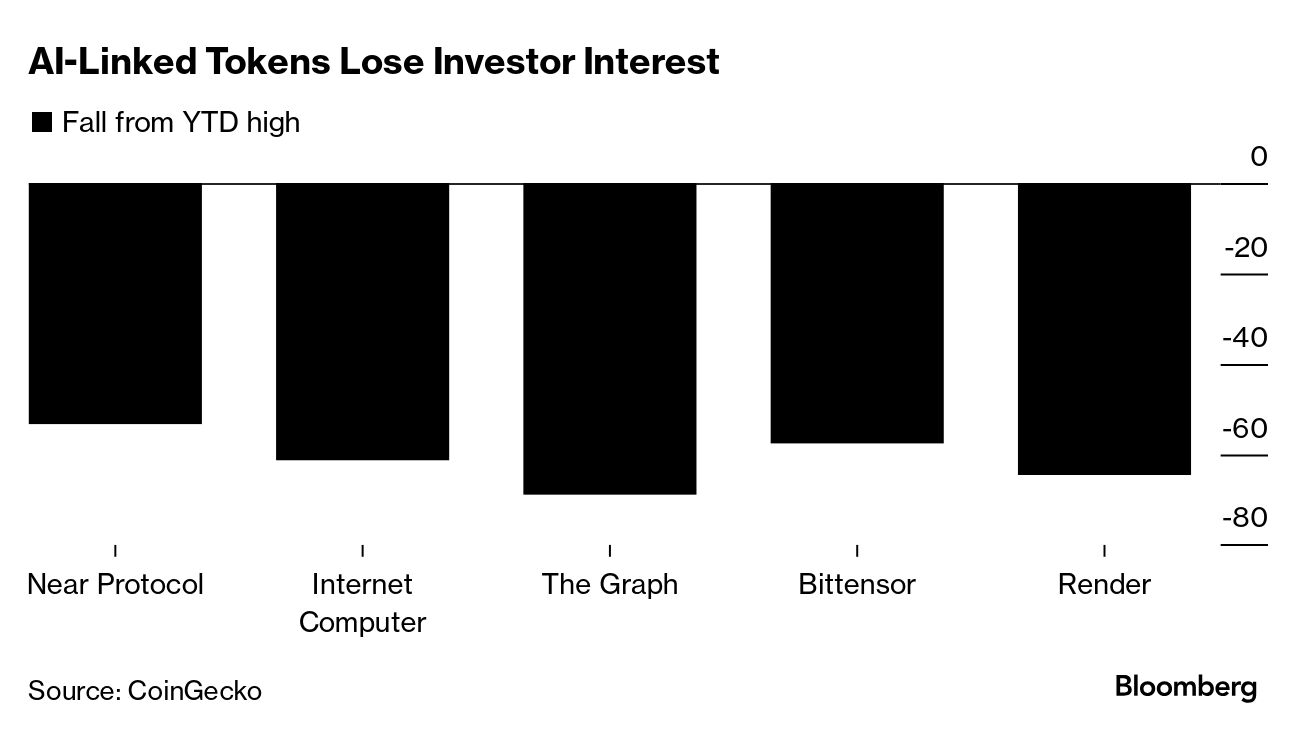

Tokens of AI-themed blockchains like Near Protocol, Internet Computer, Bittensor and Render Network have consistently fallen since March, plunging more than 50% from their 2024 peaks. Meanwhile in the equity market, an exchange traded fund tracking the performance of companies involved in AI is just about 2% away from its high of the year.

These types of tokens are typically issued by early-stage projects seeking to deploy blockchains for AI services — a marriage of technologies whose usefulness remains unproven. Render Network, for instance, seeks to provide a decentralized marketplace for buyers and sellers of computing power for use in AI processing. Blockchain technology is utilized for payment and data verification.

These tokens previously were fueled by the hype around AI breakthroughs like OpenAI's ChatGPT and the meteoric rise of chipmaker Nvidia's stock. They were particularly popular among risk-seeking South Korean traders, who accounted for nearly 19% of their global trading volume in May.

The weekly global trading volumes for these tokens have dropped precipitously from their peak in this year's first quarter, falling to just $2 billion in early August, according to a recent note from Kaiko.

It serves as a good reminder of how the broader digital-asset market is notorious for booms and busts in coins tied to popular trends, and the AI crypto craze has fizzled as the market awaits tangible delivery on these projects' promises.

Tokens of AI-themed blockchains like Near Protocol, Internet Computer, Bittensor and Render Network have consistently fallen since March, plunging more than 50% from their 2024 peaks. Meanwhile in the equity market, an exchange traded fund tracking the performance of companies involved in AI is just about 2% away from its high of the year.

These types of tokens are typically issued by early-stage projects seeking to deploy blockchains for AI services — a marriage of technologies whose usefulness remains unproven. Render Network, for instance, seeks to provide a decentralized marketplace for buyers and sellers of computing power for use in AI processing. Blockchain technology is utilized for payment and data verification.

These tokens previously were fueled by the hype around AI breakthroughs like OpenAI's ChatGPT and the meteoric rise of chipmaker Nvidia's stock. They were particularly popular among risk-seeking South Korean traders, who accounted for nearly 19% of their global trading volume in May.

The weekly global trading volumes for these tokens have dropped precipitously from their peak in this year's first quarter, falling to just $2 billion in early August, according to a recent note from Kaiko.

It serves as a good reminder of how the broader digital-asset market is notorious for booms and busts in coins tied to popular trends, and the AI crypto craze has fizzled as the market awaits tangible delivery on these projects' promises.

No comments