Ether ETFs' early days

Spot-Ether ETFs debuted during a rocky period for the cryptocurrency market. But

that hasn't stopped them from gathering assets.

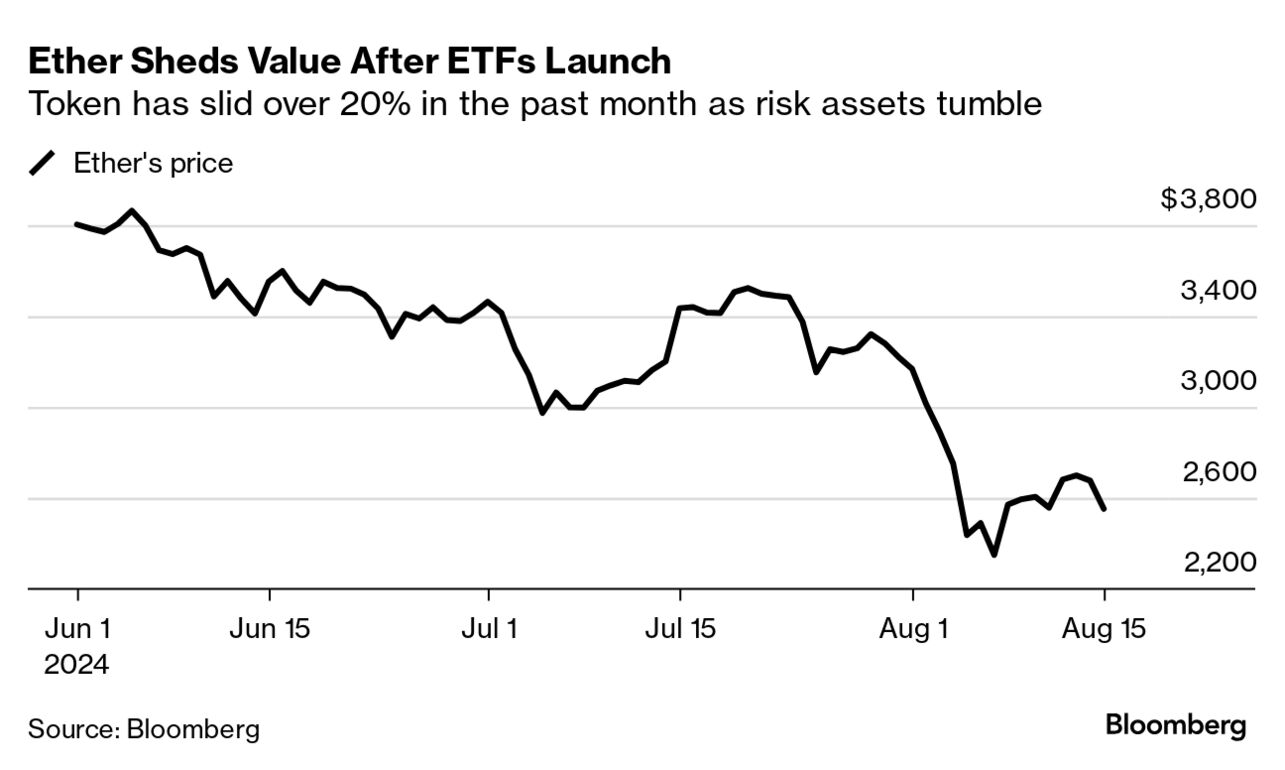

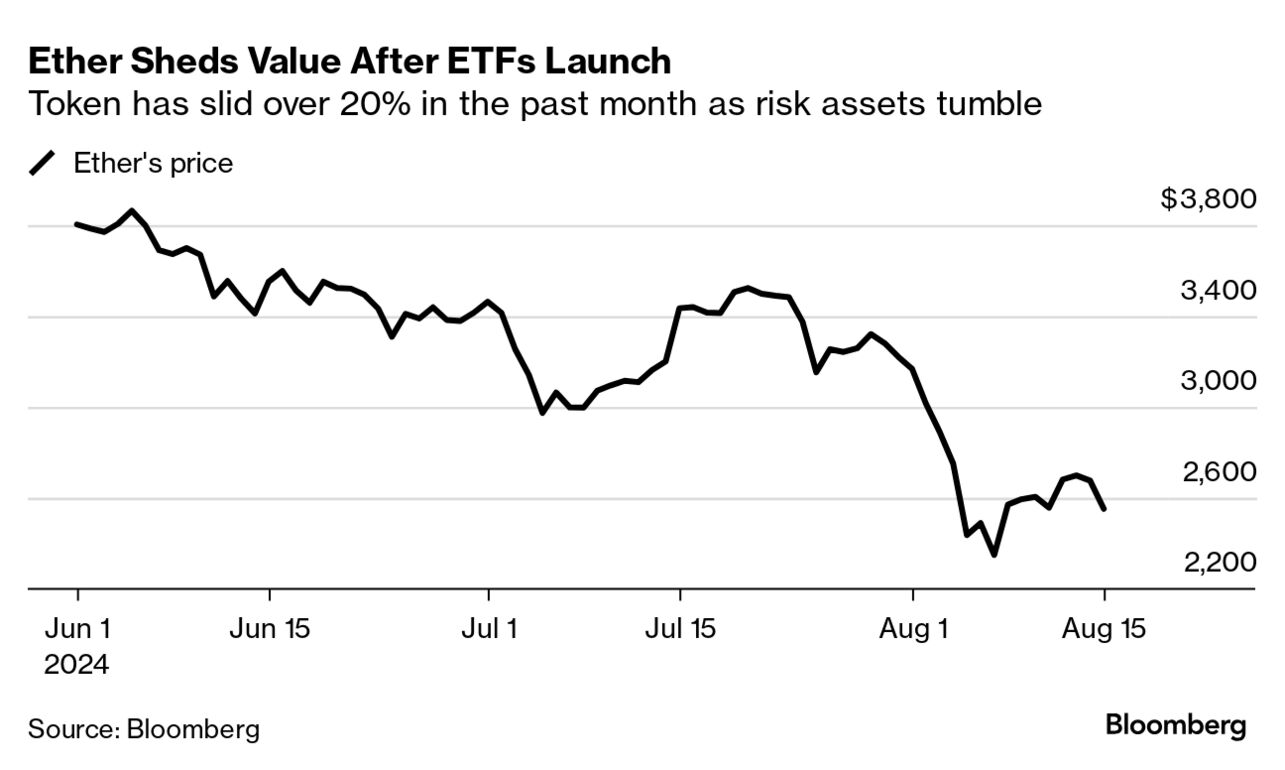

It's been less than a month since a cohort of exchange-traded funds that invest directly in Ether launched in the US. And since then, the price of the world's second-largest token has shed nearly a third of its value.

Still, eight of the nine funds that launched toward the end of July have seen money come in, with the cohort cumulatively amassing $2 billion, Bloomberg data show. Just one of them, a product that converted to an ETF when the others launched, has seen outflows over that period due to idiosyncratic reasons.

What's eye-catching about the not-so-small figure is that the stretch of time since the ETFs debuted encompasses a mini markets panic that dragged down everything from equities to loans to gold. It also ensnared Ether, which has dropped 27% since the funds launched.

And yet the Ether funds were able to notch net inflows last week and are on pace for another five-day stretch of cash infusions, albeit small ones, data through Thursday show.

"There are plenty of reasons to be nervous about the short-term outlook for crypto overall, given shifting political winds, potential interest-rate-cut disappointment and overall uncertainty," said Noelle Acheson, author of the Crypto Is Macro Now newsletter. "The fact that there have been days of net inflows now is a very encouraging sign."

The launch of Ether ETFs in the US had been much hyped and was considered a watershed moment for the cryptocurrency industry, which had been battling with regulators for years over putting out funds that are physically backed by Bitcoin and Ether. The Bitcoin ETFs, which debuted in January, had a historic trading start and now hold $50 billion between them — a number big enough that it surprised even some of the more bullish analysts watching the space.

For many crypto fans, Ether's recent slump hasn't been cause for concern. It resembles Bitcoin's slide post-launch, K33 Research analysts Vetle Lunde and David Zimmerman wrote in a note. The only difference now, they say, is the accompanying macroeconomic headwinds. Markets convulsed in recent weeks as investors recalibrated their outlooks for the health of the US economy, and as gyrations in Japanese markets sent shock waves worldwide.

To be sure, while the inflows remain impressive, they're nowhere near what Bitcoin funds took in during their early weeks. In all, the Ether ETFs amassed around 25% of the flows spot-Bitcoin funds notched in the first 15 days post-debut, according to K33 Research. Leading the race is BlackRock's iShares Ethereum Trust ETF (ticker ETHA), which took in nearly $1 billion in three weeks, followed by the Fidelity Ethereum Fund (FETH) and the Bitwise Ethereum ETF (ETHW).

It's been less than a month since a cohort of exchange-traded funds that invest directly in Ether launched in the US. And since then, the price of the world's second-largest token has shed nearly a third of its value.

Still, eight of the nine funds that launched toward the end of July have seen money come in, with the cohort cumulatively amassing $2 billion, Bloomberg data show. Just one of them, a product that converted to an ETF when the others launched, has seen outflows over that period due to idiosyncratic reasons.

What's eye-catching about the not-so-small figure is that the stretch of time since the ETFs debuted encompasses a mini markets panic that dragged down everything from equities to loans to gold. It also ensnared Ether, which has dropped 27% since the funds launched.

And yet the Ether funds were able to notch net inflows last week and are on pace for another five-day stretch of cash infusions, albeit small ones, data through Thursday show.

"There are plenty of reasons to be nervous about the short-term outlook for crypto overall, given shifting political winds, potential interest-rate-cut disappointment and overall uncertainty," said Noelle Acheson, author of the Crypto Is Macro Now newsletter. "The fact that there have been days of net inflows now is a very encouraging sign."

The launch of Ether ETFs in the US had been much hyped and was considered a watershed moment for the cryptocurrency industry, which had been battling with regulators for years over putting out funds that are physically backed by Bitcoin and Ether. The Bitcoin ETFs, which debuted in January, had a historic trading start and now hold $50 billion between them — a number big enough that it surprised even some of the more bullish analysts watching the space.

For many crypto fans, Ether's recent slump hasn't been cause for concern. It resembles Bitcoin's slide post-launch, K33 Research analysts Vetle Lunde and David Zimmerman wrote in a note. The only difference now, they say, is the accompanying macroeconomic headwinds. Markets convulsed in recent weeks as investors recalibrated their outlooks for the health of the US economy, and as gyrations in Japanese markets sent shock waves worldwide.

To be sure, while the inflows remain impressive, they're nowhere near what Bitcoin funds took in during their early weeks. In all, the Ether ETFs amassed around 25% of the flows spot-Bitcoin funds notched in the first 15 days post-debut, according to K33 Research. Leading the race is BlackRock's iShares Ethereum Trust ETF (ticker ETHA), which took in nearly $1 billion in three weeks, followed by the Fidelity Ethereum Fund (FETH) and the Bitwise Ethereum ETF (ETHW).

No comments